Loading

Get Pa Dor Rev-1220 As 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR REV-1220 AS online

Filling out the PA DoR REV-1220 AS form online can help you claim various tax exemptions efficiently. This guide provides step-by-step instructions to ensure you complete the form accurately.

Follow the steps to successfully complete the PA DoR REV-1220 AS form.

- Click ‘Get Form’ button to acquire the form and open it in your preferred document editor.

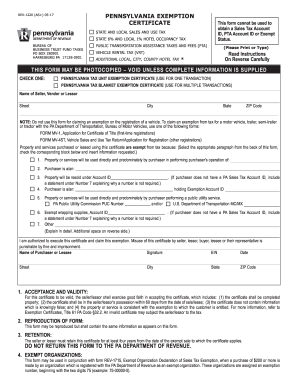

- Identify the exemption type you are claiming. Choose either 'Pennsylvania tax unit exemption certificate' for a single transaction or 'Pennsylvania tax blanket exemption certificate' for multiple transactions by checking the appropriate box.

- Enter the name of the seller, vendor, or lessor in the designated field, followed by their street address, city, state, and ZIP code.

- Select the reason for your exemption by checking the appropriate box in the section that outlines the reasons for the property or services purchased. Provide any additional information requested in the same section.

- Fill in the required fields regarding your tax identification details, such as your Pennsylvania Sales Tax Account ID, if applicable.

- Ensure that you properly authorize the certificate by signing your name, providing your Employer Identification Number (EIN), and entering the date of signing.

- Review all entered information for accuracy before saving your completed form.

- Once finalized, you can download, print, or share the completed form as needed.

Complete your PA DoR REV-1220 AS form online today for a seamless process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Exemptions from paying Pennsylvania sales tax generally include certain organizations, such as nonprofits, as well as specific transactions. For instance, educational institutions and charitable organizations often qualify for these exemptions. It is crucial to have the PA DoR REV-1220 AS completed to verify your status. Keeping current with regulations can assist in maximizing your tax savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.