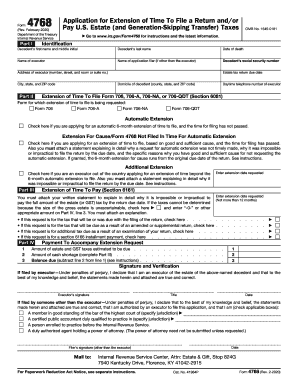

Get Irs 4768 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4768 online

How to fill out and sign IRS 4768 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, taxation, commercial, as well as other electronic documents require a high level of security and adherence to the law.

Our templates are refreshed regularly in accordance with the latest legal updates.

Our service allows you to complete the entire process of handling legal documents online. This way, you save time (if not days or even weeks) and eliminate unnecessary costs. Now, fill out IRS 4768 from your home, workplace, or even while traveling.

- Access the template in the feature-rich online editor by clicking Get form.

- Fill in the required fields highlighted in yellow.

- Press the arrow labeled Next to proceed from one field to the next.

- Utilize the e-signature option to sign the document electronically.

- Include the appropriate date.

- Review the entire template to ensure you haven’t overlooked anything.

- Click Done and download the completed form.

How to adjust Get IRS 4768 2020: personalize forms online

Eliminate the clutter from your documentation process. Uncover the easiest method to locate, modify, and submit a Get IRS 4768 2020.

The task of preparing Get IRS 4768 2020 requires precision and focus, particularly for those who are not well-acquainted with this type of work. It is crucial to obtain an appropriate template and fill it with accurate details. With the right solution for handling documents, you can have all the resources readily available.

It is simple to enhance your editing process without acquiring new abilities. Locate the correct example of Get IRS 4768 2020 and complete it immediately without toggling between your browser windows. Explore additional tools to personalize your Get IRS 4768 2020 form in the editing mode.

While on the Get IRS 4768 2020 page, just click the Get form button to commence editing it. Input your information into the form on the spot, as all necessary tools are readily accessible right here. The template is pre-arranged, so the effort required from the user is minimal. Utilize the interactive fillable fields in the editor to efficiently finalize your documentation. Simply click on the form and enter the editor mode without hesitation. Complete the interactive field, and your file is ready.

Often, a slight mistake can spoil the entire form when someone fills it out manually. Eliminate inaccuracies in your documentation. Find the templates you require quickly and complete them digitally using an intelligent editing solution.

- Insert additional text around the document as required. Utilize the Text and Text Box tools to add text in a distinct box.

- Incorporate pre-prepared graphic elements like Circle, Cross, and Check using the respective tools.

- If necessary, capture or upload visuals to the document via the Image tool.

- If you wish to draw something within the document, apply Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to tailor the text in the document.

- If you need to append comments to specific sections of the document, click the Sticky tool and add a note where desired.

You should file IRS Form 4768 with the address specified in the instructions on the form itself. Typically, the mailing address depends on whether you are enclosing a payment or not. Make sure to check the latest IRS filing guidelines to ensure you send it to the correct location. US Legal Forms can help you locate the proper address and assist you in preparing the form accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.