Loading

Get Irs Instruction 1045 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1045 online

This guide provides clear and supportive instructions on navigating the IRS Instruction 1045 online. It is tailored for individuals, estates, and trusts looking to apply for a quick tax refund related to net operating losses or unused credits.

Follow the steps to effectively complete your IRS Instruction 1045 online.

- Press the ‘Get Form’ button to access the IRS Instruction 1045. This will allow you to view and fill out the form directly online.

- Fill in your personal information at the top of the form, including your name, address, and taxpayer identification number. Ensure accuracy as it is crucial for processing.

- Complete line 1 of the form, detailing any unused general business credit relevant to your application. Attach all required computations and supporting documentation.

- If applicable, on line 1c, indicate any net section 1256 contracts loss you are carrying back. Ensure to attach the necessary forms for these entries.

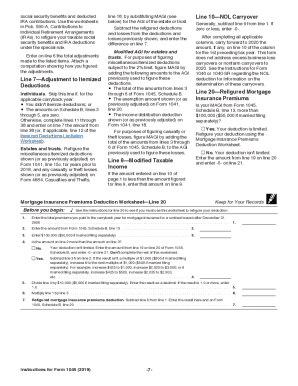

- Move on to fill out lines 10 through 32 to compute the decrease in your tax due to the carryback adjustments. This section involves entering amounts before and after the carryback for each applicable year.

- Review line 14 regarding exemptions and input the necessary details based on your tax status for the relevant years.

- Finalize the form by signing in line 25. If jointly filed, both parties must sign. Ensure to double-check all entries for accuracy before submitting.

- After filling out the form, save any changes, and consider downloading or printing a copy for your records before final submission.

Complete your IRS forms online to ensure fast and efficient processing of your application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

As of now, tax amendments cannot be filed electronically for all forms, but some may be eligible. For example, Form 1040-X can be filed electronically in certain situations. Always verify the current requirements as regulations can change, and using uslegalforms can help you stay up-to-date with your filing needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.