Get Ny Dtf Ct-3/4-i 2019

How it works

-

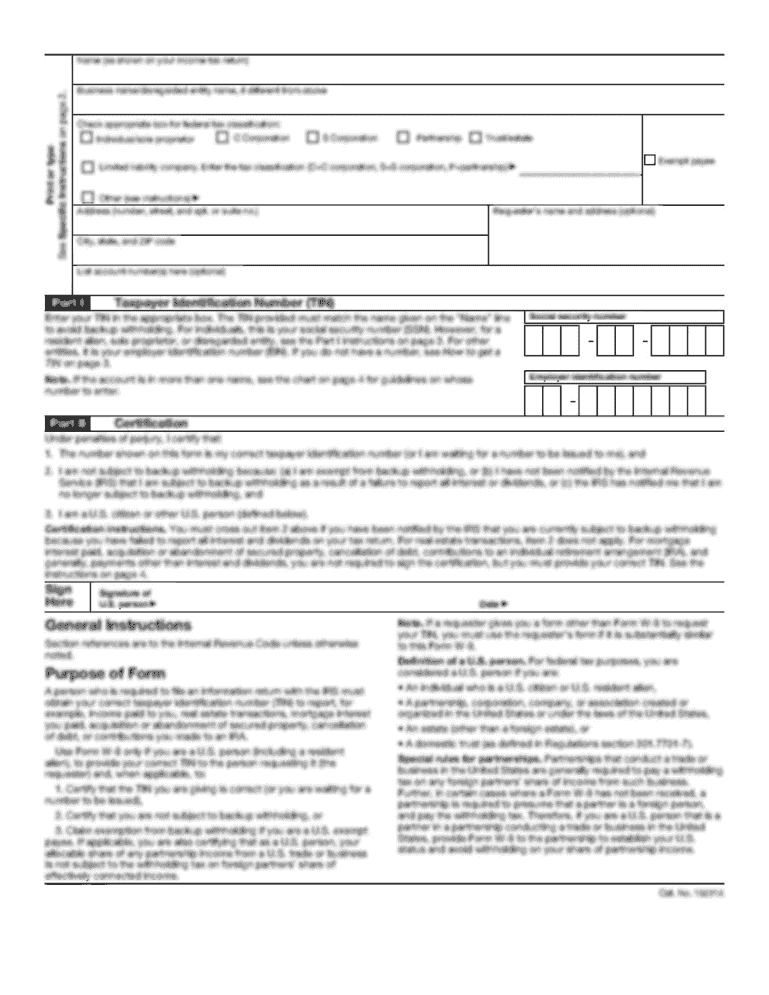

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-3/4-I online

How to modify Get NY DTF CT-3/4-I 2019: personalize forms online

Place the appropriate document management tools at your disposal. Execute Get NY DTF CT-3/4-I 2019 with our reliable service that includes editing and eSignature capabilities.

If you wish to undertake and sign Get NY DTF CT-3/4-I 2019 online seamlessly, then our online cloud-powered alternative is the ideal choice. We offer an extensive template-based library of ready-to-use documents that you can alter and finalize online. Furthermore, you don’t have to print the form or utilize third-party services to make it fillable. All necessary tools will be immediately accessible as soon as you open the document in the editor.

Let’s explore our online editing tools and their primary features. The editor presents an intuitive interface, ensuring minimal time is needed to learn how to operate it. We’ll review three main sections that allow you to:

In addition to the functionalities described above, you can secure your document with a passcode, insert a watermark, convert the document to the required format, and much more.

Our editor simplifies the editing and authorizing of the Get NY DTF CT-3/4-I 2019. It allows you to perform nearly any task related to document management. Moreover, we always guarantee that your interaction with files is safe and adheres to major regulatory standards. All these elements enhance the enjoyment of using our tool.

Obtain Get NY DTF CT-3/4-I 2019, make the necessary modifications and adjustments, and receive it in the preferred file format. Give it a try today!

- Revise and annotate the template

- The top toolbar includes tools that enable you to emphasize and obscure text, excluding images and graphical elements (lines, arrows, and checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Utilize the toolbar on the left if you wish to reorder the document or eliminate pages.

- Prepare them for distribution

- If you want to enable the document to be fillable for others and share it, you can use the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

Yes, if you are an employee in New York and want your employer to withhold state income tax, you need to fill out NY IT-2104. This form allows you to instruct your employer on how much tax to withhold from your paycheck. Ensuring this form is completed correctly can help manage your tax obligations effectively. For additional insights, you can visit US Legal Forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.