Get Pr 480.6d 2019

How it works

-

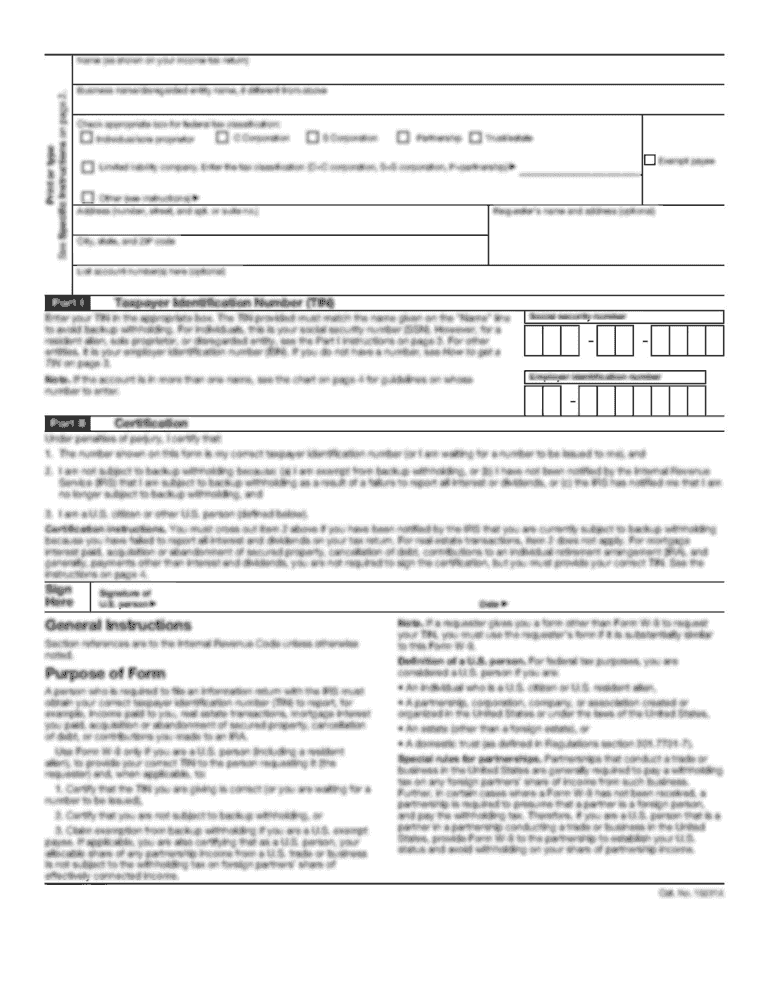

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PR 480.6D online

How to modify Get PR 480.6D 2019: personalize forms online

Take advantage of the functionality of the feature-rich online editor while completing your Get PR 480.6D 2019. Utilize the variety of tools to swiftly fill in the blanks and supply the necessary information in no time.

Creating documents can be time-consuming and costly unless you possess ready-to-use editable templates and finalize them digitally. The most efficient method to handle the Get PR 480.6D 2019 is to employ our expert and versatile online editing tools. We equip you with all the essential instruments for quick form completion and enable you to make any adjustments to your forms, tailoring them to any requirements. Furthermore, you can annotate the modifications and leave remarks for other involved parties.

Here’s what you can achieve with your Get PR 480.6D 2019 in our editor:

Handling Get PR 480.6D 2019 in our robust online editor is the quickest and most efficient way to organize, submit, and share your files as needed from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All forms you create or complete are safely stored in the cloud, ensuring you can always retrieve them when necessary, without the concern of losing them. Stop wasting time on manual document completion and eliminate paper; accomplish it all online with minimal effort.

- Complete the empty fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important elements with a preferred color or underline them.

- Conceal sensitive information utilizing the Blackout tool or simply erase it.

- Add images to illustrate your Get PR 480.6D 2019.

- Replace the original text with the one that matches your requirements.

- Include comments or sticky notes to coordinate with others regarding the updates.

- Insert extra fillable fields and allocate them to specific individuals.

- Secure the document with watermarks, dates, and bates numbers.

- Distribute the document in various methods and store it on your device or in the cloud in multiple formats upon completing modifications.

Get form

A 480 form is primarily used in Puerto Rico to report various types of income, such as wages, dividends, and interests. It is essential for taxpayers to report this information accurately to ensure compliance with Puerto Rican tax laws. Having a thorough understanding of this form is crucial for maintaining proper tax records. If you're looking to navigate PR 480.6D filings effectively, check out the tools available on uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.