Get Nm Trd Acd-31015 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM TRD ACD-31015 online

How to fill out and sign NM TRD ACD-31015 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The preparation of legal documents can be costly and time-consuming. Nevertheless, with our ready-made online templates, everything becomes easier.

Now, working with a NM TRD ACD-31015 takes no more than 5 minutes. Our state-specific web-based forms and clear instructions eliminate human errors.

Send it immediately to the recipient. Utilize the quick search and advanced cloud editor to generate an accurate NM TRD ACD-31015. Streamline the process and create documents online!

- Select the web template from the collection.

- Fill in all necessary information in the required fields.

- The intuitive drag & drop interface enables you to add or rearrange fields.

- Ensure all information is correctly filled out, with no mistakes or missing sections.

- Apply your e-signature to the PDF page.

- Click on Done to save the updates.

- Download the data file or print your PDF version.

How to modify Get NM TRD ACD-31015 2020: tailor forms online

Utilize our comprehensive online document editor while preparing your documentation. Complete the Get NM TRD ACD-31015 2020, highlight the key aspects, and effortlessly make any additional modifications to its content.

Preparing documents digitally is not only efficient but also allows you to adjust the template to fit your preferences. If you’re about to work on Get NM TRD ACD-31015 2020, think about finalizing it with our robust online editing tools. Whether you make a typographical error or input the requested information in the incorrect field, you can swiftly correct the form without needing to restart it from the top as you would with manual input.

Additionally, you can emphasize the essential information in your document by accentuating particular sections with colors, underlining them, or highlighting them.

Our powerful online tools are the optimal way to complete and alter Get NM TRD ACD-31015 2020 to suit your needs. Use it to prepare personal or professional documentation from anywhere. Access it in a browser, make any updates to your documents, and revisit them at any time in the future - they will all be securely stored in the cloud.

- Open the document in the editor.

- Input the required information in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t skip any essential fields in the template.

- Highlight some of the vital details and attach a URL to them if needed.

- Utilize the Highlight or Line features to stress the most significant facts.

- Choose colors and thickness for these lines to give your sample a professional appearance.

- Remove or obscure the information you wish to keep hidden from view.

- Replace segments of content with errors and enter the text you require.

- Conclude adjustments with the Done option once you confirm everything is accurate in the document.

Get form

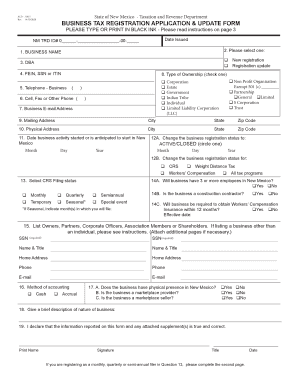

To obtain a New Mexico business tax identification number, fill out the appropriate forms on the New Mexico Taxation and Revenue Department's website. This identification number is crucial for tax reporting and is connected to your NM TRD ACD-31015. Be sure to have all pertinent information ready to expedite the process and ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.