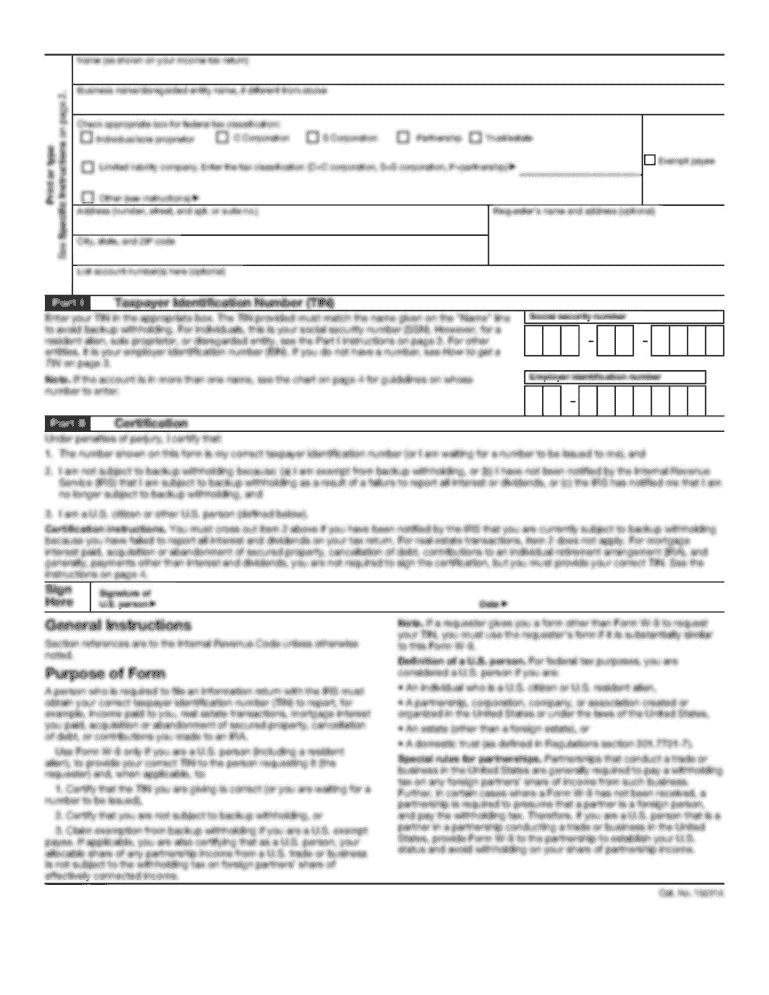

Get In Dor E-6 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IN DoR E-6 online

How to Modify Get IN DoR E-6 2019: Personalize Forms Online

Choose a robust document alteration solution you can rely on. Alter, execute, and validate Get IN DoR E-6 2019 safely online.

Frequently, altering documents, such as Get IN DoR E-6 2019, can prove difficult, particularly if you possess them in a digital format but lack access to specialized software. Obviously, you might employ some alternatives to navigate this, but you risk obtaining a form that does not meet the submission standards. Utilizing a printer and scanner is not viable either, as it consumes time and resources.

We offer a more seamless and efficient method of altering files. A comprehensive array of document templates that are easy to customize and validate, and make fillable for others. Our offering goes far beyond merely a collection of templates. One of the greatest advantages of using our services is that you can modify Get IN DoR E-6 2019 directly on our platform.

As it is a web-based solution, it spares you the need to procure any software. Moreover, not all corporate protocols allow you to install it on your work computer. Here’s the simplest way to effortlessly and securely process your documents with our solution.

Forget about paper and other inefficient methods for altering your Get IN DoR E-6 2019 or other documents. Use our tool instead, which combines one of the most extensive libraries of ready-to-edit forms with robust document editing services. It’s simple and secure, and can save you significant time! Don’t just take our word for it, try it yourself!

- Click the Get Form button; you'll be promptly directed to our editor.

- Once opened, initiate the editing process.

- Select checkmark or circle, line, arrow, and cross and additional options to annotate your document.

- Choose the date field to incorporate a specific date into your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to add fillable fields.

- Select Sign from the top toolbar to create and insert your legally-binding signature.

- Click DONE to save, print, share, or retrieve the document.

Get form

Related links form

To file an amended CT tax return, first complete the necessary forms to indicate the changes you need to make. Once you've filled them out, submit them to the Connecticut Department of Revenue Services. Timeliness is critical, as it helps you correct errors and reduces potential penalties. If you're unsure, consider using uslegalforms for guidance through the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.