Loading

Get Sc Dor Sc1040x 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040X online

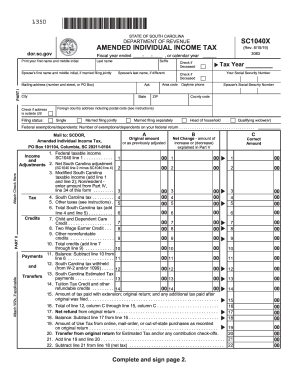

Filling out the SC DoR SC1040X online is a structured process that allows users to amend individual income tax returns. This guide provides clear instructions to assist you in completing each section of the form accurately.

Follow the steps to successfully complete your SC DoR SC1040X online.

- Select the ‘Get Form’ button to access the SC DoR SC1040X form and open it in the online editor.

- In Part I, enter the tax year for the return. Fill in your name, Social Security Number, and mailing address accurately. Ensure you indicate your filing status and the number of dependents from your federal return.

- Move to Part II, where you will input the amounts from your original return in Column A. If there are any changes, record them in Column B and calculate the correct amounts in Column C.

- Complete the tax liability calculations. Enter your corrected federal taxable income, South Carolina adjustments, and total tax amounts as prompted in the lines outlined.

- If applicable, fill out Part IV for nonresidents using the adjusted figures from your Schedule NR.

- In Part V, provide a detailed explanation for any changes that you made to the original return, attaching any relevant documentation as necessary.

- Finalize the process by signing the form, ensuring that both spouses sign if filing jointly. Review the information for accuracy before submission.

- Once completed, you can save changes, download, print, or share the SC DoR SC1040X form as needed.

Start filling out your SC DoR SC1040X online to ensure your tax return is updated accurately.

Yes, non-residents are required to file an income tax return if they earn income from South Carolina sources. It's essential to understand your tax responsibilities to avoid any legal issues. When using SC DoR SC1040X, you will find the necessary steps to comply with the tax regulations. This proactive approach will help you maintain your financial integrity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.