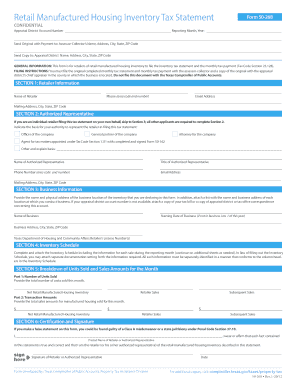

Get Tx Comptroller 50-268 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign TX Comptroller 50-268 online

How to alter Get TX Comptroller 50-268 2020: tailor forms online

Streamline your document preparation workflow and adapt it to your requirements with just a few clicks. Complete and verify Get TX Comptroller 50-268 2020 utilizing a detailed yet user-friendly online editor.

Handling documents can be challenging, especially when it's not part of your regular tasks. It requires you to meticulously follow all procedures and thoroughly complete all fields with precise and complete information. However, it often occurs that you need to modify the form or add additional fields to fill in. If you need to refine Get TX Comptroller 50-268 2020 before submission, the easiest approach is to utilize our powerful yet easy-to-navigate online editing tools.

This all-encompassing PDF editing solution allows you to swiftly and easily accomplish legal documents from any device with internet access, make fundamental adjustments to the form, and incorporate more fillable fields. The service allows you to designate a specific section for each type of data, such as Name, Signature, Currency, and SSN, among others. You can set these fields as mandatory or conditional and determine who should complete each section by assigning them to a designated recipient.

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and seamlessly adjusting Get TX Comptroller 50-268 2020 along with other templates to meet your specifications. Reduce document preparation and submission time while ensuring your paperwork looks impeccable without complications.

- Access the required template from the library.

- Complete the empty spaces with Text and apply Check and Cross tools to the checkboxes.

- Use the right-side menu to modify the template with new fillable fields.

- Choose the fields based on the type of information you wish to gather.

- Set these fields as mandatory, optional, and conditional and organize their sequence.

- Assign each section to a particular individual using the Add Signer function.

- Verify that you have made all the necessary changes and click Done.

Related links form

To close a business with the Texas Comptroller, you need to file the appropriate dissolution forms with both the Comptroller's office and the Secretary of State. Before dissolving, settle any outstanding taxes or obligations to avoid complications. Once these steps are completed, you will receive confirmation from the Comptroller. Uslegalforms offers guidance on this procedure to ensure that every requirement is met.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.