Get Tx Comptroller 50-266 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

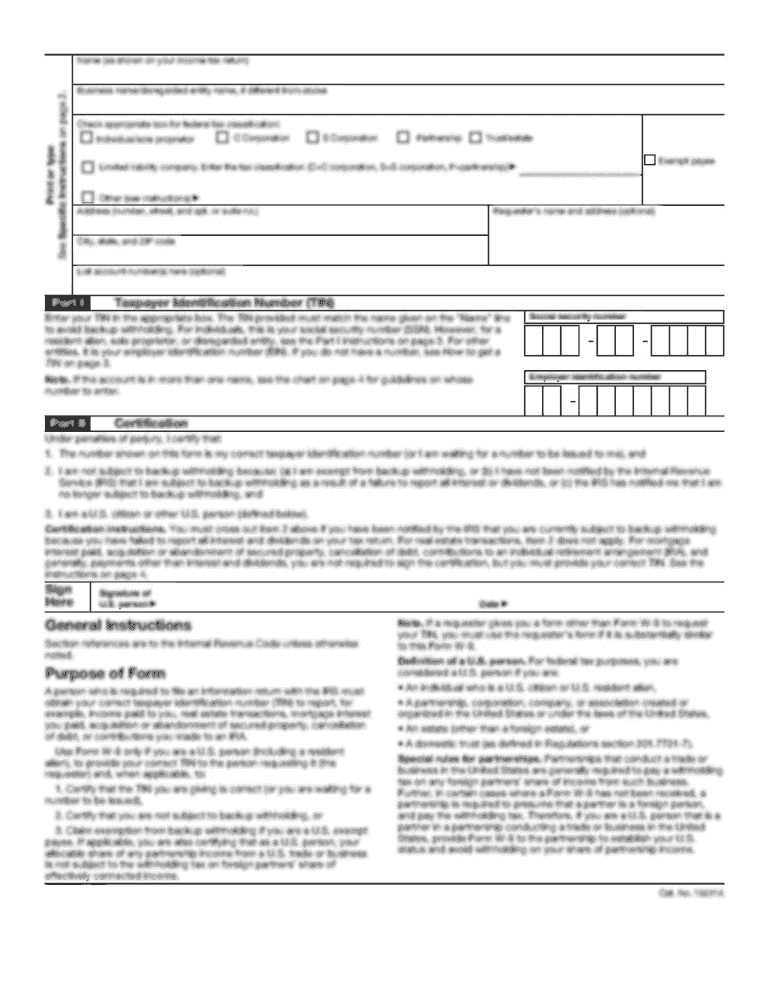

How to fill out the TX Comptroller 50-266 online

This guide provides a step-by-step process for filling out the TX Comptroller 50-266, the Heavy Equipment Inventory Tax Statement. Whether you are a dealer of heavy equipment or an authorized representative, this guide will help you navigate the online form with ease.

Follow the steps to complete the TX Comptroller 50-266 online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the appraisal district account number in the designated field. Ensure that this number accurately corresponds to your dealings with heavy equipment.

- Fill in the reporting month and year. This information is critical as it pertains to the specific tax period being reported.

- Provide your dealer information in Section 1, including your name, phone number, email address, and mailing address.

- If applicable, complete Section 2 for the authorized representative. Indicate your authority to represent the dealer and provide the required contact information.

- In Section 3, input the business name and the physical address where the heavy equipment inventory is located. Attach a list of all business locations if multiple.

- Proceed to Section 4, the Inventory Schedule, where you will detail each sale during the reporting month. Complete this section carefully, attaching any necessary documentation.

- Continue to Section 5, where you will report the breakdown of heavy equipment units sold, leased, or rented, alongside the transaction amounts.

- Finally, in Section 6, provide a certification and your signature. Ensure all information provided is truthful to avoid legal implications.

- After reviewing the completed form, save changes and choose your preferred option to download, print, or share the form as required.

Complete your filing of the TX Comptroller 50-266 online today to ensure compliance.

The Texas comptroller is responsible for various financial duties, including tax administration, budget preparation, and revenue forecasting. This office plays a critical role in ensuring the state maintains a balanced budget. Familiarizing yourself with the TX Comptroller 50-266 will help you comprehend how these responsibilities may impact your financial planning. US Legal Forms can provide tools to navigate these responsibilities effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.