Get Tx 5200 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 5200 online

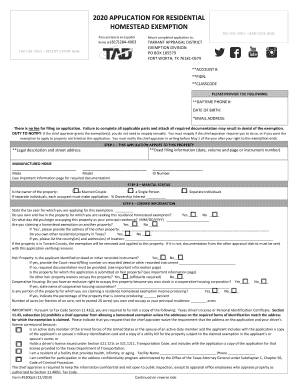

Filing for a residential homestead exemption can be a straightforward process when you know what to do. This guide provides clear, step-by-step instructions for completing the TX 5200 form online, ensuring you understand each section and field.

Follow the steps to successfully fill out the TX 5200 form

- Click the ‘Get Form’ button to access the TX 5200 form online and open it in your preferred editor.

- Start by entering necessary identification details, such as your account number and PIDN, which can usually be found on previous tax documents. This information is essential for processing your exemption request.

- Fill in the owner name section. Be sure to include your full legal name as it appears on your identification documents. If applicable, enter the additional owner's name.

- Input the complete owner street address, including city, state, and zip code. Ensure this matches the address on your identification.

- Provide your daytime phone number and email address. This information will be useful for any necessary follow-ups regarding your application.

- Indicate your date of birth, as this may be relevant for age-related exemptions. Ensure the date format is consistent with the application guidelines.

- Complete the deed filing information section by entering the necessary details about your property, including date, volume, and page or instrument number.

- Mark your marital status by selecting the appropriate option. If filing as separate individuals, indicate the percentage of ownership interest.

- In the owner information section, specify the tax year for which you are applying and confirm whether you live on the property as your principal residence.

- Indicate if you are claiming a homestead exemption for any other property. If yes, provide the address.

- Review and check the exemptions that apply to your circumstances, such as age or disability. Ensure to attach any necessary documentation required for each exemption.

- Finish filling out the form by reviewing all entered details for accuracy. Once complete, you can save your changes, download the form, and choose to print or share it as needed.

Complete your TX 5200 form online today to ensure your residential homestead exemption is processed efficiently.

Get form

To fill out a W-9 form for an individual, provide your name as it appears on your tax return and the associated identification number, typically your Social Security Number. Ensure that you check the appropriate box to indicate your tax classification. The completed form may need to be submitted to the entity requesting it for tax purposes, including any transactions related to your TX 5200 activities. Uslegalforms offers guidance on how to complete tax forms correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.