Loading

Get De Wcwt-6 - Wilmington 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE WCWT-6 - Wilmington online

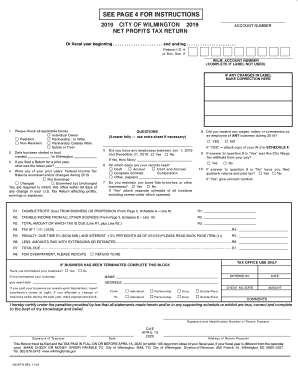

Completing the DE WCWT-6 - Wilmington form online is an essential step for properly reporting your net profits tax. This guide provides a clear, step-by-step approach to ensure you accurately fill out the form and meet your tax obligations.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the DE WCWT-6 - Wilmington form and open it in the appropriate online editor.

- Enter your account number, federal ID number or social security number, and Wilmington account number if the label is not used. Ensure that any changes in the label are corrected here.

- Check all applicable blocks indicating your business type — options include individual owner, resident, partnership in Wilmington, non-resident, partnership outside Wilmington, or estate/trust.

- Provide the date your business started or the trust was created within Wilmington.

- Answer the questions regarding employment and income accurately, using additional sheets if necessary for responses that require more space.

- Fill out the tax-related fields, including your taxable profit or loss from business, ensuring you follow the calculations and entering the necessary figures from the attached schedules.

- Complete the penalties and interest sections, ensuring any prior payments are accounted for correctly.

- If your business has been terminated, indicate so and provide the necessary details about the termination date and purchaser's name if applicable.

- Review your entries for accuracy, ensuring all information is correct and complete before finalizing.

- Finally, you can save your changes, download the completed form, print it, or share it as required.

Start filling out your DE WCWT-6 - Wilmington form online today to ensure compliance with local tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form DE 6 is the Delaware Employer Withholding Tax Return. It is used to report employee wages and calculate the state income tax withheld in Delaware. If you are filing for a business in Wilmington, understanding the DE WCWT-6 - Wilmington and its requirements will enhance your compliance with tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.