Get Ny Dtf Ifta-105.1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

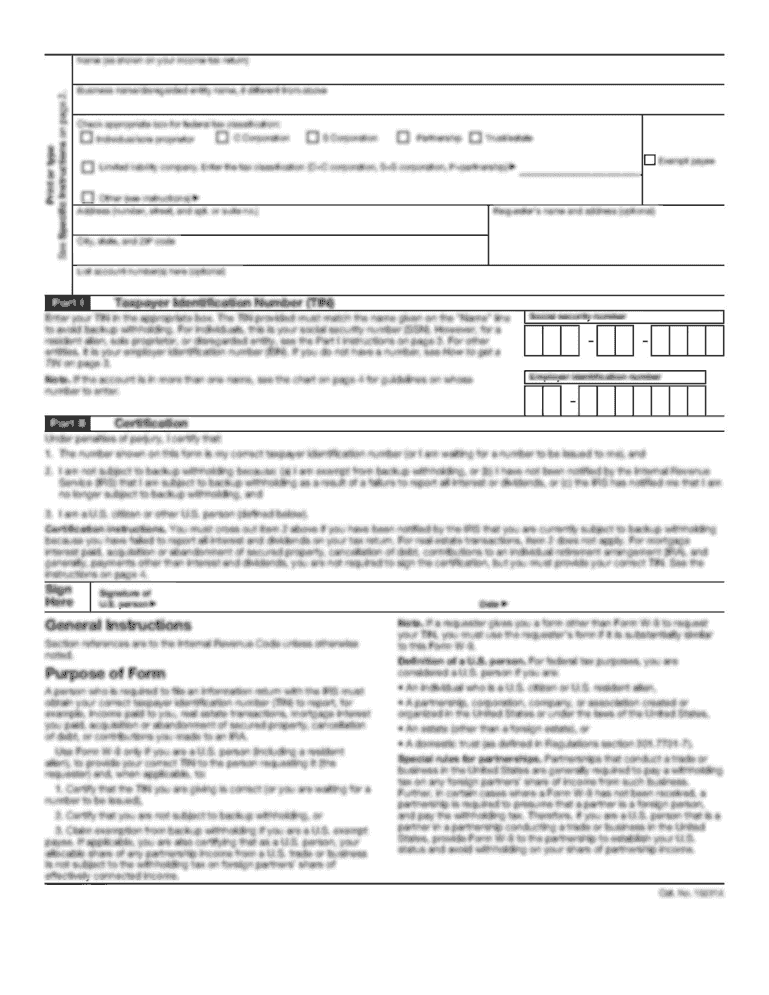

Tips on how to fill out, edit and sign NY DTF IFTA-105.1 online

How to Modify Get NY DTF IFTA-105.1 2019: Personalize Forms Online

Utilize our sophisticated editor to transform a basic online template into a finished document.

Keep reading to discover how to alter Get NY DTF IFTA-105.1 2019 online effortlessly.

Once you locate a suitable Get NY DTF IFTA-105.1 2019, simply tailor the template to suit your desires or legal stipulations.

Besides populating the fillable form with precise information, you may need to eliminate sections in the document that do not pertain to your situation. Conversely, you might want to incorporate some absent clauses in the original template. Our advanced document modification features are the optimal way to amend and refine the document.

The editor allows you to alter the content of any form, even if the file is in PDF format. You can insert and remove text, add fillable fields, and implement further changes while maintaining the original formatting of the document. Additionally, you can reorganize the structure of the document by adjusting the order of the pages.

Access the desired template.

Utilize the toolbar to modify the template as per your needs. Fill in the form with accurate details. Click on the signature field to add your electronic signature. If required, send the document for signature to additional signers. Once all participants finalize the document, you will receive a signed copy that you can download, print, and distribute to others. Our services help you save significant time and reduce the likelihood of errors in your documents. Enhance your document workflows with efficient editing features and a robust eSignature solution.

- You do not need to print the Get NY DTF IFTA-105.1 2019 to authorize it.

- The editor includes electronic signature functionalities.

- Most forms are already equipped with signature fields.

- You only need to insert your signature and request one from the other signing party through email.

- Follow this step-by-step guide to complete your Get NY DTF IFTA-105.1 2019:

Get form

Setting up an IFTA account involves filling out the NY DTF IFTA-105.1 application form with your business details. Follow the instructions carefully and submit the required documents to your state’s IFTA office. Once approved, you'll gain access to your account, where you can manage your fuel tax reporting easily and effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.