Loading

Get Md Comptroller Mw 507 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW 507 online

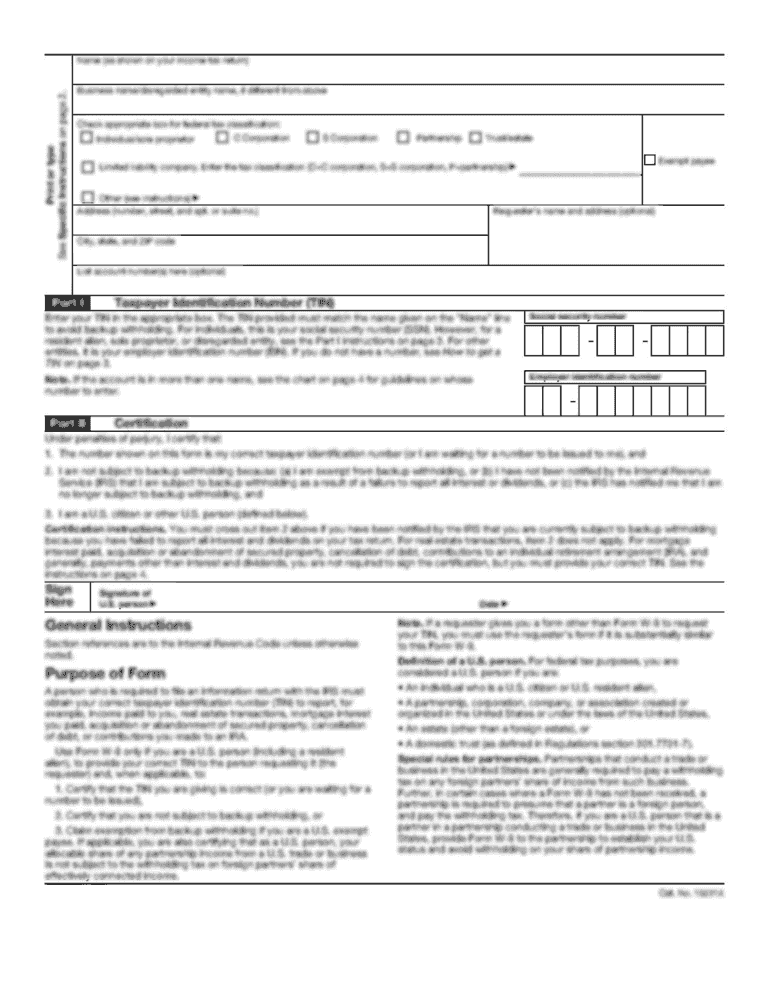

The MD Comptroller MW 507 form is essential for ensuring the correct withholding of Maryland income tax from your pay. This guide provides clear, step-by-step instructions on how to complete the form online, helping you navigate each section with ease.

Follow the steps to complete your MW 507 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name and Social Security number in the designated fields of the form.

- Provide your street address, including city, state, and ZIP code, ensuring accuracy for official correspondence.

- Indicate your county of residence. If you do not reside in Maryland, enter the Maryland county where you are employed.

- Select your filing status by checking the appropriate box: Single, Married (surviving spouse or unmarried head of household), or Married but withhold at the single rate.

- On line 1, input the total number of personal exemptions you are claiming on your tax return. If claiming more than a specified number, complete the Personal Exemption Worksheet on page 2.

- If you wish to have additional withholding per pay period, enter the amount on line 2.

- For line 3, check the boxes that apply to claim an exemption from withholding if you do not expect to owe Maryland income tax.

- On line 4, certify your exemption status if you are domiciled in the District of Columbia, Virginia, or West Virginia and do not maintain a place of abode in Maryland.

- Complete line 5 if you are a Pennsylvania resident claiming exemption from Maryland state withholding based on specific criteria.

- Fill out lines 6 and 7 if you qualify for exemptions from local tax based on your Pennsylvania residency.

- On line 8, if you qualify under the Servicemembers Civil Relief Act, indicate your state of domicile and attach necessary documentation.

- Sign and date the form, affirming that the information provided is accurate under penalty of perjury.

- Once completed, save your changes. You can download, print, or share the form as needed.

Complete your MD Comptroller MW 507 form online for accurate tax withholding.

Yes, you can e-file an amended Maryland tax return using certain tax preparation software that supports this feature. E-filing is an efficient way to submit your amendment, and it is highly recommended for a quicker processing time with the MD Comptroller. Ensure that you select the option for an amended return when filing to avoid any issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.