Get Ca Ftb 541 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 541 online

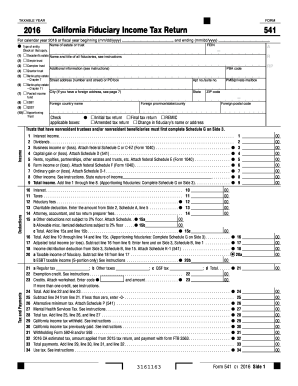

The California Fiduciary Income Tax Return, known as CA FTB 541, is a crucial document for estates and trusts reporting income in California. This guide provides clear, step-by-step instructions on how to fill out the CA FTB 541 online, ensuring a smooth and efficient filing process.

Follow the steps to complete your CA FTB 541 online effectively.

- Select the ‘Get Form’ button to retrieve the CA FTB 541 and open it for editing.

- Fill in the taxable year at the top of the form. Indicate whether it is for the calendar year or for a fiscal year by providing the starting and ending dates.

- Designate the type of entity by checking the appropriate boxes for decedent's estate, simple trust, complex trust, grantor trust, bankruptcy estate, pooled income fund, or other types as applicable.

- Enter the name of the estate or trust and the Federal Employer Identification Number (FEIN) in the designated fields.

- Provide the complete street address or P.O. Box for the estate or trust, including city, state, and ZIP code. If applicable, include foreign address information.

- Indicate if this is an initial tax return, final tax return, amended return, or if there has been a change in fiduciary’s name or address by checking the appropriate boxes.

- Report your income in the section provided, including categories such as interest income, dividends, business income, capital gains, and other forms of income. Calculate the total income and ensure all necessary schedules are attached.

- Fill out the deductions section, listing any expenses like taxes, fiduciary fees, charitable deductions, and other relevant deductions. Calculate total deductions accurately.

- Determine the taxable income by subtracting total deductions from total income, ensuring accuracy in each calculation.

- Proceed to review each section of the form for completeness and correctness before you save, download, or print your completed form.

Complete your CA FTB 541 online today for timely and accurate filing.

Get form

California withholding applies to a variety of entities, including employers paying wages, and partnerships with California source income. If you have employees or are distributing income that falls under California tax law, withholding requirements will likely apply. It’s critical to accurately withhold and remit taxes to avoid penalties. For detailed information, consider consulting resources like uslegalforms that simplify these processes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.