Loading

Get Nj Dot Git/rep-3 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT GIT/REP-3 online

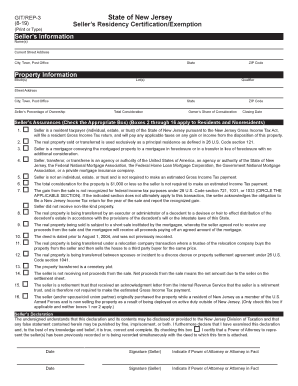

Filling out the NJ DoT GIT/REP-3 form is essential for individuals or entities selling property in New Jersey who wish to certify their residency or claim an exemption from Gross Income Tax obligations. This guide provides you with step-by-step instructions to easily complete the form online.

Follow the steps to efficiently complete the NJ DoT GIT/REP-3 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the seller's name(s) as it appears on identification documents. If there are multiple sellers, each individual needs to complete a separate form unless they file taxes jointly as a married or civil union couple.

- Fill in the current street address, city, town, or post office of the seller’s primary residence. Note that this should not be the address of the property being sold.

- Next, provide the property information. Enter the block and lot numbers as specified on the property deed, along with the state and ZIP code.

- Indicate the seller's percentage of ownership in the property and the total consideration, which represents the total monetary value exchanged during the transaction. Signify your share of this consideration and the planned closing date.

- Review the Seller’s Assurances section. Check the correct box(es) that apply to the seller’s situation regarding residency and income tax obligations. Ensure that any claims for exemptions are properly supported.

- Complete the Seller’s Declaration by signing and dating it. If a Power of Attorney or representative is involved, ensure that they have the necessary authority to submit the declaration.

- Finally, save changes to your completed form, download a copy for your records, and print or share the document as needed for submission.

Start filing documents online today for a smoother transaction process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The New Jersey Git-Er tax is specifically aimed at income generated from estates and trusts. Understanding this tax is crucial for fiduciaries and administrators managing these entities. The NJ DoT GIT/REP-3 form provides the necessary framework for reporting income and ensuring compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.