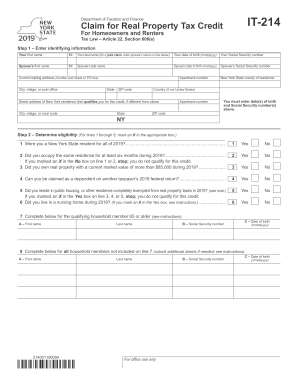

Get Ny Dtf It-214 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-214 online

How to modify Get NY DTF IT-214 2019: personalize documents online

Position the proper document management features at your fingertips. Finalize Get NY DTF IT-214 2019 with our reliable service that includes editing and electronic signature capabilities.

If you wish to complete and sign Get NY DTF IT-214 2019 online effortlessly, then our cloud-based solution is the ideal choice. We provide an extensive template-based catalog of ready-to-use documents that you can edit and finalize online.

Additionally, there is no need to print the form or utilize external tools to make it fillable. All essential tools will be readily accessible upon opening the document in the editor.

Modify and annotate the template

The top toolbar is equipped with tools to help you emphasize and obscure text, excluding images and visual elements (such as lines, arrows, and checkmarks), add your signature, initialize, date the form, and more.

Organize your documents

- Assess our online editing features and their vital functions.

- The editor has an easy-to-use interface, ensuring a quick learning curve.

- We’ll explore three primary sections that allow you to:

Get form

Related links form

Yes, you can paper file a New York state tax return if you prefer not to file online. Simply download and fill out the necessary forms, such as the NY DTF IT-214, and send them to the appropriate address. Just keep in mind that processing times may take longer with paper filings. Always ensure your forms are complete to prevent delays.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.