Loading

Get Ma Schedule C 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

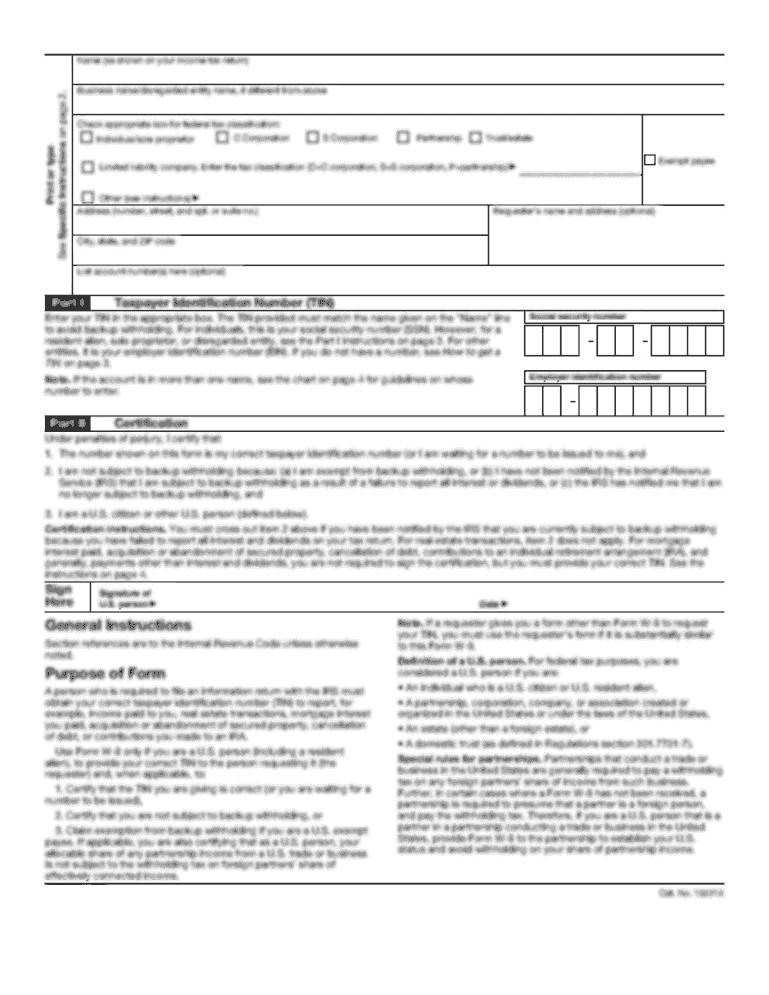

The MA Schedule C is an essential form used to report profit or loss from a business operated by a sole proprietor in Massachusetts. This guide provides a step-by-step approach to help users fill out the form accurately and efficiently.

Follow the steps to complete your MA Schedule C online:

- Press the ‘Get Form’ button to obtain the MA Schedule C form and open it in your preferred editor.

- Enter your first name, middle initial, and last name in the designated fields.

- Provide your Social Security number in the corresponding field.

- Fill in your business name as it appears on official documents.

- If applicable, input your Employer Identification Number (EIN) in the respective field.

- Indicate your main business or profession, specifying the product or service you offer.

- Find the Principal Business Code from the U.S. Schedule C and include it in the designated section.

- Provide your mailing address, including street number and name, city or town, state, and ZIP code.

- If applicable, fill in your foreign address details, including province/state/county, postal code, and country.

- Enter the number of employees you had during the reporting year.

- Select your accounting method: Cash, Accrual, or Other, and specify if using the Other option.

- Indicate if you materially participated in your business during the reporting year and if you started or acquired this business in that year.

- Respond to questions regarding payments that require you to file Form 1099 and any suspended passive activity losses (PAL).

- Report if you claimed the small business exemption from sales tax.

- Complete the lines for gross receipts or sales, returns and allowances, and calculate gross profit.

- Report other income and calculate your total gross income.

- Enter expenses by filling in the appropriate lines for various costs such as advertising, bad debts, car expenses, and more.

- Sum total expenses to find your total expenses and calculate your tentative profit or loss.

- Complete the sections related to business use of home and any applicable deductions.

- Finally, review your entries, save your changes, download, print, or share the completed form as necessary.

Start filling out your MA Schedule C online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You, as a self-employed individual, create your own MA Schedule C. While many choose to do this themselves, some may opt for professional help to ensure accuracy. A reliable accountant can assist with this task, helping you navigate any complexities. US Legal Forms also offers solutions to help you prepare your Schedule C correctly and with confidence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.