Loading

Get Md Sdat 1 Instructions 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD SDAT 1 Instructions online

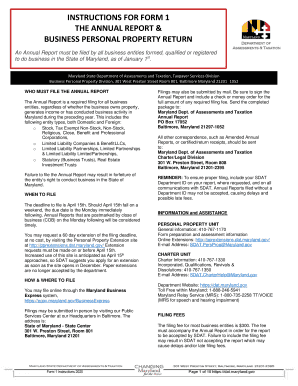

This guide provides comprehensive instructions for users looking to complete the MD SDAT 1 form online. The process is designed to be straightforward, making it accessible for individuals with varying levels of legal experience.

Follow the steps to successfully complete the MD SDAT 1 Instructions.

- Press the ‘Get Form’ button to access the MD SDAT 1 Instructions and open the form in an online editor.

- Begin filling out the form by selecting the appropriate box for your business type at the top of the form. Ensure you note the associated filing fee for your entity.

- Complete Section I by providing the full legal name of the business, the complete mailing address, and the SDAT Department ID. Make sure to check the box if this is a new mailing address.

- Include the Federal Employer Identification Number (FEIN) and the Federal Principal Business Code obtained from the IRS.

- Continue through the form by filling in any required information, including the nature of your business and any change to your business mailing address.

- If your business is a corporation, complete Section II with the names and addresses of all corporate officers and directors.

- Skip to Section III for all business entities to indicate ownership or use of personal property in Maryland. Respond accurately to each question.

- Sign Section IV to certify the information provided is accurate and complete. Ensure to include a valid date and contact information.

- After filling out the form, review all sections for accuracy and completeness. Make any necessary corrections.

- Once finalized, you can save your changes, download, print, or share the completed form as needed.

Complete your MD SDAT 1 form online today for efficient processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The penalty for filing late varies based on the specific document and duration of the delay. Generally, there are fixed fees associated with late submissions, and these can accumulate if not addressed promptly. To ensure you stay compliant and avoid penalties, always refer to the MD SDAT 1 Instructions for each form you need to submit. Using platforms like uslegalforms can help you manage deadlines effectively and maintain your business's standing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.