Loading

Get Pa Dor 83-a272a 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR 83-A272A online

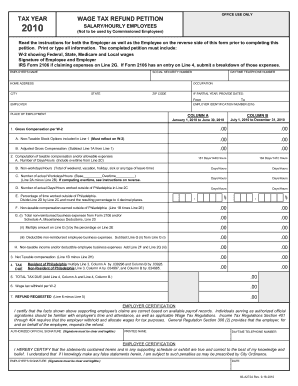

The PA DoR 83-A272A is a wage tax refund petition form for salary and hourly employees in Philadelphia. This guide will help you navigate each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain the PA DoR 83-A272A document and open it in your preferred editor.

- Begin filling in the employee's name and social security number in the designated fields. Ensure that this information is accurate as it will be used to verify your identity.

- Enter the home address, including city, state, and zip code. Provide a daytime telephone number for contact purposes.

- If applicable, indicate the dates of employment for the partial year you are claiming for by specifying the start and end dates.

- Fill in the employer's details, including the employer's name and employer identification number (EIN). Also, note the place of employment.

- Proceed to the compensation sections, entering the gross compensation as stated on your W-2 while also accounting for any non-taxable stock options.

- Complete the computation of taxable compensation sections, ensuring to detail the number of actual workdays/hours and include any overtime if relevant.

- If claiming non-reimbursed expenses, ensure to attach IRS Form 2106 along with any necessary supporting documents.

- Both the employee and employer must provide their signatures on the petition form to validate the claims made.

- Once all required fields are completed, review your entries for accuracy before proceeding to save the changes, download, print, or share the completed form.

Complete your PA DoR 83-A272A online today to ensure your wage tax refund is properly submitted!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing a final sales tax return in Pennsylvania involves submitting the appropriate return, typically the PA DoR 83-A272A, to the Pennsylvania Department of Revenue. Make sure to indicate that it is your final return by checking the relevant box on the form. It's crucial to reconcile any final sales tax collections. You can conveniently access the necessary forms and instructions from USLegalForms to assist you in this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.