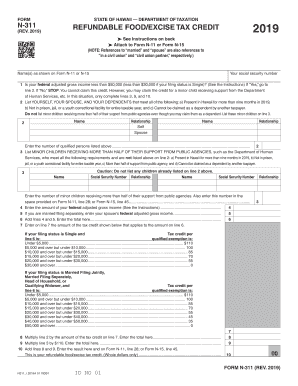

Get Hi N-311 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI N-311 online

How to fill out and sign HI N-311 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The creation of legal documents can be expensive and lengthy. Nevertheless, with our pre-made online templates, everything becomes easier. Now, producing a HI N-311 takes no longer than 5 minutes.

Our state-specific web-based samples and straightforward guidelines eliminate human errors.

Send promptly to the recipient. Utilize the quick search and advanced cloud editor to create a correct HI N-311. Eliminate the tediousness and generate documents online!

- Locate the template in the directory.

- Fill in all necessary information in the designated fields.

- The user-friendly drag-and-drop interface enables you to add or move fields.

- Verify that everything is filled out accurately, free of typos or missing sections.

- Add your digital signature to the PDF page.

- Just click Done to save the changes.

- Download the documents or print your copy.

How to revise Get HI N-311 2019: personalize forms digitally

Completing documentation is easier with intelligent online solutions. Remove paperwork with effortlessly accessible Get HI N-311 2019 templates that you can modify online and print.

Drafting documents and paperwork doesn't need to be complicated, whether it's a regular duty or a sporadic task. When someone has to submit a Get HI N-311 2019, learning the rules and guides on how to properly fill a form and what it should contain can consume considerable time and energy. However, if you discover the right Get HI N-311 2019 template, completing a form will no longer be a challenge with a smart editor available.

Uncover a wider range of features that you can integrate into your document workflow. There's no need to print, complete, and annotate forms by hand. With a sophisticated editing platform, all essential document processing functionalities are readily available. If you wish to enhance your work with Get HI N-311 2019 forms, locate the template in the directory, select it, and experience a simpler way to complete it.

The more tools you master, the easier it becomes to handle Get HI N-311 2019. Explore the solution that delivers everything crucial to locate and modify forms in a single browser tab and bid farewell to manual paperwork.

- If you want to incorporate text in any part of the form or introduce a text field, utilize the Text and Text field tools to expand the text in the form as much as necessary.

- Employ the Highlight tool to emphasize important sections of the form. If you need to conceal or eliminate certain text sections, apply the Blackout or Erase tools.

- Personalize the form by adding standard graphic elements. Use the Circle, Check, and Cross tools to include these components in the forms, if feasible.

- For additional comments, utilize the Sticky note feature and insert as many notes on the forms page as needed.

- If the form demands your initials or date, the editor provides tools for that as well. Reduce the chances of mistakes by utilizing the Initials and Date tools.

- It's also straightforward to incorporate custom visual elements into the form. Use the Arrow, Line, and Draw tools to modify the document.

Get form

As mentioned earlier, obtaining a Hawaii tax ID number involves applying through the Department of Taxation. You can complete this either online or via mail. If you're unsure about the forms or processes, consider using US Legal Forms to ensure you're following the correct steps.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.