Loading

Get Hi Dot N-323 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-323 online

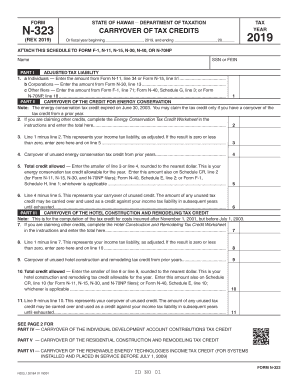

The HI DoT N-323 form is essential for reporting the carryover of tax credits for various types of taxpayers in Hawaii. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can efficiently manage their tax credit information.

Follow the steps to successfully complete the HI DoT N-323 form.

- Press ‘Get Form’ button to obtain the HI DoT N-323 and open it in the editor.

- Fill in the tax year and enter your name and Social Security Number (SSN) or Federal Employer Identification Number (FEIN). This information is crucial for identifying your tax records.

- For Part I, report your adjusted tax liability. Depending on your filing status, enter the corresponding amounts from Form N-11, N-15, N-30, N-40, or Form F-1 on the appropriate lines.

- In Part II, if you are claiming the Energy Conservation Tax Credit, complete the Energy Conservation Tax Credit Worksheet per the provided instructions. Enter the total on line 2.

- Calculate your adjusted income tax liability by subtracting line 2 from line 1 for Part II. If the result is zero or less, enter zero on line 3 and line 5.

- Complete the carryover section by entering any unused credits from prior years on line 4. Determine the total credit allowed based on the lesser of lines 3 or 4, rounded to the nearest dollar and enter that on line 5.

- Continue to Parts III through VIII reporting any additional carryover tax credits from other specific categories, following similar steps to complete each part.

- After filling out all relevant sections of the form, review your entries for accuracy.

- Once completed, you can save changes, download, print, or share the HI DoT N-323 form as needed.

Start completing your HI DoT N-323 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Non-residents must file a tax return if they earn income from sources within Hawaii. This typically involves completing Form N-15 to report their income and calculate any taxes owed. Resources, such as HI DoT N-323, can help clarify any uncertainties regarding the filing process for non-residents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.