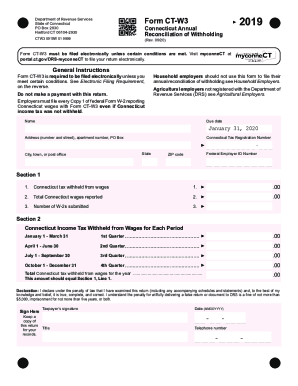

Get Ct Drs Ct-w3 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-W3 online

How to amend Get CT DRS CT-W3 2019: personalize documents online

Utilize our comprehensive online document editor while finalizing your paperwork. Complete the Get CT DRS CT-W3 2019, highlight the key points, and effortlessly implement any other vital adjustments to its content.

Preparing documents digitally is not only efficient but also provides a chance to modify the template according to your preferences. If you are set to handle the Get CT DRS CT-W3 2019, think about filling it out with our powerful online editing tools. Whether you make an error or input the required information in the incorrect field, you can promptly adjust the form without the need to restart it from the beginning as you would with manual completion.

Additionally, you can highlight the essential information in your documents by coloring certain sections, underlining them, or encircling them.

Our extensive online tools are the most efficient means to complete and adjust Get CT DRS CT-W3 2019 according to your requirements. Use it to manage personal or corporate documents from any location. Access it in a browser, modify your forms as needed, and return to them at any time in the future - they will all be securely stored in the cloud.

- Access the form in the editor.

- Enter the necessary information in the blank fields using Text, Check, and Cross tools.

- Follow the form navigation to avoid overlooking any mandatory fields in the template.

- Encircle some of the crucial details and add a URL to it if necessary.

- Employ the Highlight or Line tools to underscore the most significant pieces of content.

- Choose colors and thickness for these lines to ensure your form appears professional.

- Eliminate or obscure the information you want to keep hidden from others.

- Replace sections of text that contain errors and enter the information you require.

- Conclude modifications with the Done option once you confirm everything is accurate in the form.

Get form

Yes, Connecticut is a mandatory withholding state, meaning employers must withhold state income tax from employee wages. Failing to comply can lead to penalties and additional liabilities for the employer. Understanding the rules around withholding, such as using the CT DRS and the CT-W3 form, helps ensure your business remains compliant.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.