Loading

Get Ok Form 511 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 511 online

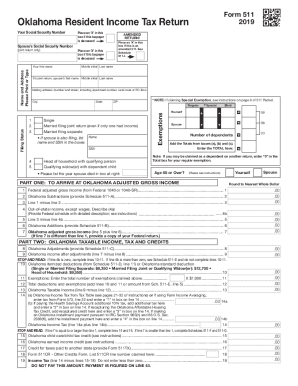

Filing your Oklahoma resident income tax return, known as OK Form 511, online can simplify the process, ensuring accuracy and timeliness. This guide will provide you with clear, step-by-step instructions to assist you in completing the form effectively.

Follow the steps to successfully fill out the OK Form 511 online.

- Click the 'Get Form' button to obtain the form. This action will allow you to access the OK Form 511 in an interactive format.

- Fill in your personal information at the top of the form. This includes entering your Social Security number, mailing address, and selecting your filing status (Single, Married Filing Joint, etc.).

- Provide the required information about your income. On the corresponding lines, state your Federal Adjusted Gross Income and any applicable subtractions based on the provided schedules.

- Calculate your Oklahoma taxable income by subtracting your total deductions and exemptions from your income. Utilize the available deductions, including standard or itemized options as per your eligibility.

- If you are eligible for any credits, such as child care or earned income credits, fill out the corresponding sections along with the schedules.

- Choose how to receive your refund. Provide direct deposit information to speed up processing or check the option to receive a debit card if direct deposit is not selected.

Start filing your documents online now to simplify your tax preparation process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain Oklahoma tax forms, including the OK Form 511, from the Oklahoma Tax Commission's website. Alternatively, local libraries or tax preparation centers may also carry these forms. For an efficient way to manage your tax documents, consider using platforms like uslegalforms, which provides easy access to various tax forms, including those required by Oklahoma.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.