Get Pa Dced Clgs-32-6 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

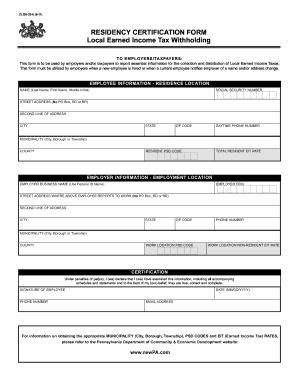

Tips on how to fill out, edit and sign PA DCED CLGS-32-6 online

How to fill out and sign PA DCED CLGS-32-6 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a significant difficulty and a major hassle if adequate support is not provided. US Legal Forms serves as an online resource for PA DCED CLGS-32-6 e-filing and offers numerous benefits for taxpayers.

Use the guidelines on how to complete the PA DCED CLGS-32-6:

Hit the Done button in the upper menu once you have finished it. Save, download, or export the completed form. Utilize US Legal Forms to ensure a smooth and effortless PA DCED CLGS-32-6 completion.

- Access the template on the site in the designated section or through the Search engine.

- Press the orange button to launch it and wait for the process to finish.

- Examine the blank form and adhere to the instructions. If you've never filled out the form before, follow the step-by-step guidelines.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you're unsure what to input, refer to the instructions.

- Always sign the PA DCED CLGS-32-6. Utilize the integrated tool to create the electronic signature.

- Click the date field to automatically populate the appropriate date.

- Review the form to verify and modify it before the e-filing.

How to modify Get PA DCED CLGS-32-6 2011: personalize forms online

Utilize our robust online document editor to take full advantage while preparing your documents. Complete the Get PA DCED CLGS-32-6 2011, specify the key details, and easily implement any additional required alterations to its content.

Completing documents digitally not only saves time but also allows you to modify the template according to your preferences. If you’re set to handle the Get PA DCED CLGS-32-6 2011, consider finalizing it with our powerful online editing features. Whether you make an error or input the required information in the incorrect section, you can effortlessly adjust the form without the need to start anew as you would during manual completion. Moreover, you can emphasize important information in your document by highlighting specific sections with colors, underlining them, or encircling them.

Follow these quick and straightforward steps to finalize and modify your Get PA DCED CLGS-32-6 2011 online:

Our comprehensive online solutions are the most efficient method to fill out and personalize Get PA DCED CLGS-32-6 2011 according to your requirements. Use it to prepare personal or professional documents from anywhere. Open it in a browser, make any changes to your forms, and return to them at any time in the future - they will all be securely stored in the cloud.

- Open the document in the editor.

- Fill in the necessary details in the empty spaces using Text, Check, and Cross tools.

- Follow the form navigation to ensure no critical areas are overlooked in the template.

- Circle some of the vital details and add a URL to it if required.

- Utilize the Highlight or Line options to emphasize the most significant information.

- Select colors and thickness for these lines to give your form a polished appearance.

- Erase or blackout the information you wish to remain unseen by others.

- Substitute sections of content that contain errors and enter the text you require.

- Conclude modifications with the Done key once you confirm everything is accurate in the form.

Get form

You’ll need to file PA Schedule A if you itemize your deductions rather than taking the standard deduction. This form is essential for reporting unique deductions allowed by Pennsylvania. It’s advisable to follow the instructions linked with the PA DCED CLGS-32-6 to ensure you're correctly completing and submitting your forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.