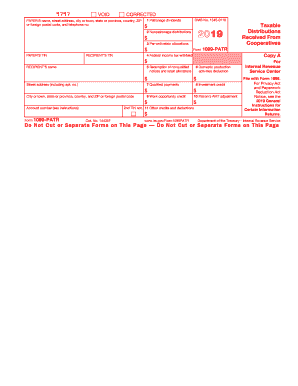

Get Irs 1099-patr 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-PATR online

How to fill out and sign IRS 1099-PATR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Discover all the advantages of submitting and finalizing documents online. With our platform, submitting the IRS 1099-PATR typically takes just a few minutes. We facilitate this by providing access to our comprehensive editor capable of altering/correcting a document's original wording, incorporating unique fields, and enabling e-signatures.

Complete the IRS 1099-PATR in just a few minutes by following the steps outlined below:

Send your completed IRS 1099-PATR in a digital format as soon as you finish filling it out. Your information is securely protected, as we adhere to the latest security protocols. Join millions of satisfied customers who are already completing legal forms from the comfort of their homes.

- Locate the template you need in the collection of legal form samples.

- Press the Get form button to access the document and begin editing.

- Complete all the necessary fields (they will appear in a yellowish color).

- The Signature Wizard will allow you to insert your e-signature after you've finished entering details.

- Include the date.

- Review the entire document to ensure that everything is filled out correctly and no amendments are necessary.

- Click Done and download the completed template to your computer.

How to Adjust Get IRS 1099-PATR 2019: Personalize Forms Online

Locate the ideal Get IRS 1099-PATR 2019 template and modify it instantly. Streamline your documentation with an intelligent document adjustment solution for online forms.

Your daily routine with documents and forms can be more productive when you have everything you require in one location. For instance, you can search for, access, and modify Get IRS 1099-PATR 2019 in a single browser tab. If you need a specific Get IRS 1099-PATR 2019, it is effortless to find it with the assistance of the intelligent search engine and reach it right away. There’s no need to download it or look for an external editor to adjust it and input your information. All necessary resources for effective work are available in one consolidated solution.

This editing solution enables you to personalize, complete, and sign your Get IRS 1099-PATR 2019 form right away. Upon finding an appropriate template, click on it to enter the editing mode. Once you open the form in the editor, you have all the vital tools at your disposal. You can effortlessly fill in the designated fields and remove them if required with the aid of a straightforward yet versatile toolbar. Implement all changes immediately, and sign the form without leaving the tab by simply clicking the signature field. After that, you can send or print your document if necessary.

Make additional custom modifications with the provided tools.

Uncover new possibilities in streamlined and effortless documentation. Locate the Get IRS 1099-PATR 2019 you require in minutes and complete it in the same tab. Eliminate the clutter in your paperwork for good with the assistance of online forms.

- Annotate your document using the Sticky note tool by placing a note at any location within the document.

- Insert requisite visual elements, if needed, with the Circle, Check, or Cross tools.

- Adjust or include text anywhere in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Alter the template text with the Highlight and Blackout, or Erase tools.

- Incorporate custom visual elements with the Arrow, Line, or Draw tools.

Get form

The IRS Form 1099-PATR is a tax document that reports patronage dividends received from cooperatives. It provides detailed information about dividend amounts, including various boxes that reflect different types of distributions. Understanding this form is essential for accurate tax reporting and compliance with IRS guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.