Loading

Get Ca Ftb 540x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540X online

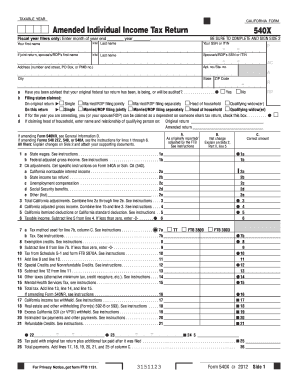

Filing an amended individual income tax return can feel daunting, but understanding the CA FTB 540X form is essential for correcting any mistakes on your original return. This guide will provide you with clear, step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to successfully complete the CA FTB 540X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year in the designated field at the top of the form, specifying the year for which you are amending the return.

- Fill in your first name, middle initial, last name, and your Social Security Number or Individual Taxpayer Identification Number.

- If filing a joint return, also provide your spouse's or registered domestic partner's first name, middle initial, last name, and their Social Security Number or Individual Taxpayer Identification Number.

- Complete the address section, making sure to include the number and street, city, state, and ZIP code.

- Indicate if you have been notified that your original federal tax return is being audited by selecting 'Yes' or 'No'.

- Select your filing status for both the original return and the current amended return from the options provided.

- If applicable, check the box to indicate if you or your spouse can be claimed as a dependent on someone else's tax return.

- Complete the financial sections by accurately reporting amounts for state wages, federal adjusted gross income, California adjustments, and any relevant credits or deductions.

- In the explanation section, provide detailed changes you are making to your tax return, along with supporting documents.

- Review all information entered for accuracy, making sure that all required fields are completed.

- You can now save changes, download, print, or share the form for submission as per your preference.

Start filling out the CA FTB 540X online to ensure your tax return is accurate and up-to-date.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should file your CA FTB 540X with the California Franchise Tax Board. Depending on your zip code, the mailing address may differ, so it's essential to verify the correct address for your return. Filing your amended return online can streamline this process. The US Legal Forms platform provides relevant addresses along with detailed instructions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.