Loading

Get Pa Berkheimer F-1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Berkheimer F-1 online

This guide provides clear and concise instructions on how to complete the PA Berkheimer F-1 form online. Whether you are a first-time user or need a refresher, this step-by-step guide will help ensure your form is completed accurately.

Follow the steps to fill out the PA Berkheimer F-1 effectively

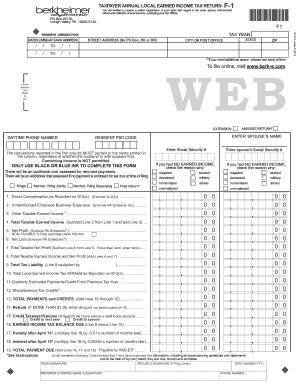

- Click ‘Get Form’ button to access the PA Berkheimer F-1 form and open it in your online editor.

- Fill in your personal information, including your name, address, city, state, and zip code. Ensure that you use the correct details as they appear in official documents.

- Indicate your tax year and resident jurisdiction. Make sure this is accurate to avoid complications in processing your return.

- Provide the number of days you lived at each address during the tax year. If you need more space, check the back of the form.

- Enter your day-time phone number and the extension if applicable. This information helps the tax office contact you if needed.

- If applicable, enter your spouse's name and social security number. Only complete this section if filing jointly.

- Input your gross compensation reported on W-2 forms in the designated section. Remember to enclose necessary documentation, such as your W-2(s).

- Complete the subsequent lines referring to your taxable income and any deductions such as unreimbursed employee business expenses.

- Calculate your total tax liability by following the specified instructions for each line. This includes calculating any tax credits, payments, and taxes due.

- Finalize your form by reviewing all entries for accuracy, then save changes. You can download your completed form, print it, or share it as needed.

Complete your PA Berkheimer F-1 document online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

An F-1 tax form includes necessary documents required for tax filing by international students under the F-1 visa. These forms may include IRS Form 8843 and the appropriate tax return forms like 1040NR. The PA Berkheimer F-1 filing process helps ensure students comply with local tax laws while focusing on their studies.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.