Loading

Get Pa Berkheimer F-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Berkheimer F-1 online

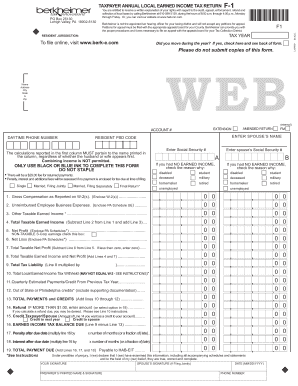

Completing the PA Berkheimer F-1 form is essential for accurately reporting your local earned income taxes. This guide offers a step-by-step approach to filling out the form online, ensuring clarity and support throughout the process.

Follow the steps to successfully submit your local earned income tax return.

- Click the ‘Get Form’ button to obtain the PA Berkheimer F-1 form and access it in your online editor.

- Begin by entering your personal information, including your name, address, and Social Security number. Ensure all details are accurate to avoid delays.

- Select your filing status by checking the appropriate box for 'Single,' 'Married Filing Jointly,' or 'Married Filing Separately.'.

- Report your gross compensation as shown on your W-2 forms. Attach copies of your W-2(s) to support your reported income.

- Enter any unreimbursed employee business expenses by including the Pennsylvania Schedule UE, which you will need to attach.

- If applicable, report any other taxable earned income on the designated line. This may include bonuses or additional income not captured on your W-2.

- Calculate your total taxable earned income by subtracting line 2 (unreimbursed expenses) from line 1 (gross compensation) and adding any income reported on line 3.

- If you are self-employed, calculate your net profit or loss and include any required Pennsylvania schedules.

- Complete the necessary calculations for total tax liability based on the tax rate provided, recording this on the relevant line.

- Enter any local earned income tax withheld, making sure to verify the correct amounts to avoid discrepancies.

- List any quarterly estimated payments or credits that you may apply from the previous tax year.

- If you are eligible for state credits, carefully input these amounts, providing any required documentation.

- Total your payments and credits, reflecting the sum of all relevant entries on lines 10, 11, and 12.

- If applicable, calculate the refund amount to which you are entitled, ensuring it aligns with your documented credits.

- Review the entire form for accuracy before finalization and select whether to credit any refund to your account or next year's taxes.

- Once all fields are filled, proceed to save your changes. You can then download, print, or share the completed form as needed.

Complete your PA Berkheimer F-1 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Pennsylvania taxes non-residents on income earned in the state through local earned income taxes. This tax can vary by municipality, so it is vital to be aware of the specific rate applicable to your earnings. Utilizing the PA Berkheimer F-1 can help ensure accurate calculations and timely payments of these taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.