Loading

Get In Dlgf Hc10 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DLGF HC10 online

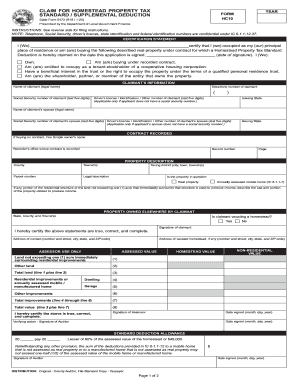

The IN DLGF HC10 form is essential for claiming a homestead property tax standard or supplemental deduction in Indiana. This guide provides a clear, step-by-step process to assist users in filling out the form accurately and efficiently online.

Follow the steps to complete your IN DLGF HC10 form online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Begin by reading the certification statement. Here, you must indicate the nature of your residence situation, selecting from options such as owning the property or being in a contract to purchase it.

- Provide the claimant’s information, including the legal name, telephone number, and the last five digits of the Social Security number, if applicable. If you do not have a Social Security number, input the last five digits of your driver’s license or identification number.

- Fill in the details regarding the contract recorded if applicable. Include the fee simple owner's name, the recorder's office location, record number, and page number for the contract.

- In the property description section, input your county, township, parcel number, and provide a legal description of the property. Identify the taxing district and clarify if the property is real estate or a mobile home.

- If some parts of the property are used to produce income, describe how and what portion of the property is utilized for that purpose.

- Document any property you own elsewhere and indicate if you are vacating a homestead.

- Sign where indicated to certify that all statements provided are true, correct, and complete, and include your contact address.

- Finally, review all entries for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your IN DLGF HC10 form online today for a smoother filing process!

Related links form

The Indiana supplemental homestead deduction offers additional savings for certain homeowners, providing extra reductions on property taxes. This deduction applies to individuals meeting specific age and income criteria, as outlined in IN DLGF HC10. It can significantly ease financial pressures for eligible residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.