Loading

Get Keystone Clgs-32-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KEYSTONE CLGS-32-1 online

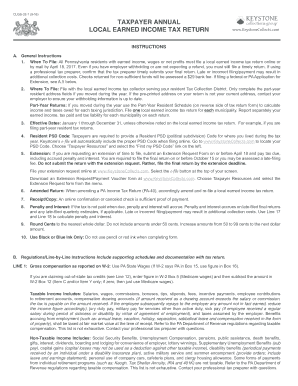

Filling out the KEYSTONE CLGS-32-1 form, also known as the Taxpayer Annual Local Earned Income Tax Return, is essential for Pennsylvania residents with earned income. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the KEYSTONE CLGS-32-1 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your personal information as prompted, ensuring that your current address is recorded accurately. If it does not match the pre-printed address, contact your employer to update your withholding information.

- Complete Line 1 by reporting your gross compensation as documented on your W-2. Make sure to use the correct figures from the appropriate boxes on your W-2.

- Proceed to Line 2, where you will list any allowable employee business expenses. Ensure you attach a copy of your PA Schedule UE or other relevant documentation.

- For Line 3, report other taxable earned income not included on Line 1 or Line 5, including any necessary supporting documents such as Form 1099.

- Calculate your total taxable earned income on Line 4 by subtracting Line 2 from Line 1 and adding Line 3.

- If you have a net profit or loss from business activities, document it on Lines 5 and 6, attaching any relevant schedules if applicable.

- Complete Line 9 by calculating your tax liability based on the total taxable earned income and local earned income tax rate.

- Enter any earned income tax withheld on Line 10, using the information from your W-2, and make adjustments as necessary.

- On Line 12, apply credits for taxes paid out-of-state or to Philadelphia, ensuring you include proper documentation.

- Continue filling out the form by entering any payments made and calculating any refunds or balances due as indicated from Lines 13 to 19.

- Once all sections of the form are complete, ensure to review your information for accuracy. You may then save changes, download, print, or share the form as needed.

Complete your KEYSTONE CLGS-32-1 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can pick up federal tax forms at various places, including local libraries, government offices, and some community centers. However, to ensure you have all the necessary forms at your fingertips, visit uslegalforms for a comprehensive collection, including the KEYSTONE CLGS-32-1. It simplifies the tax preparation process by making forms readily available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.