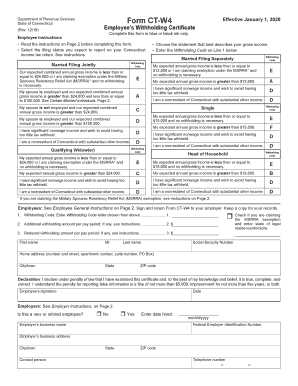

Get Ct Drs Ct-w4 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-W4 online

How to fill out and sign CT DRS CT-W4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the essential advantages of completing and submitting forms online. With our solution, filling out CT DRS CT-W4 typically takes just a few minutes. We enable this by providing you with access to our comprehensive editor capable of altering or correcting a document's original text, adding unique fields, and affixing your signature.

Execute CT DRS CT-W4 in merely a few clicks by simply adhering to the instructions below:

Send the new CT DRS CT-W4 in digital format as soon as you finish completing it. Your data is well-secured, as we adhere to the latest security standards. Join numerous satisfied customers who are already completing legal forms from their homes.

- Locate the document template you require from our collection of legal forms.

- Select the Get form button to open the document and commence editing.

- Fill in the requested fields (these are highlighted in yellow).

- The Signature Wizard will allow you to add your e-autograph once you've completed entering information.

- Insert the date.

- Review the entire form to verify that you've provided all the information and that no amendments are needed.

- Click Done and download the completed form to your device.

How to modify Get CT DRS CT-W4 2019: personalize forms on the web

Put the appropriate document management features at your disposal. Accomplish Get CT DRS CT-W4 2019 with our reliable service that integrates editing and eSignature capabilities.

If you wish to finalize and authenticate Get CT DRS CT-W4 2019 online effortlessly, then our cloud-based solution is the perfect answer. We provide a rich library of template-based forms ready for modification and completion online. Moreover, there's no requirement to print the form or utilize external tools to render it fillable. All the essential features will be accessible once you access the document in the editor.

Let’s explore our online editing features and their primary attributes. The editor has a user-friendly interface, so it won't require much time to master how to use it. We’ll review three main sections that enable you to:

In addition to the functionalities mentioned above, you can protect your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies the process of modifying and certifying the Get CT DRS CT-W4 2019. It enables you to do practically everything related to document management. Furthermore, we consistently ensure that your experience with documents is secure and complies with major regulatory standards. All these aspects contribute to making our tool more enjoyable to use.

Obtain Get CT DRS CT-W4 2019, make the necessary revisions and adjustments, and receive it in your preferred file format. Give it a try today!

- Modify and annotate the template

- The upper toolbar includes tools that assist you in highlighting and obscuring text, excluding images and graphic elements (lines, arrows, checkmarks, etc.), signing, initializing, dating the form, and more.

- Arrange your documents

- Utilize the left toolbar if you wish to reorganize the form or eliminate pages.

- Prepare them for distribution

- If you want to make the document fillable for others and share it, you can use the tools on the right to insert various fillable fields, signatures and dates, text boxes, etc.

Get form

Related links form

The DRS payment plan in Connecticut is designed to assist individuals who owe back taxes. This plan allows you to settle your tax debts over time, providing you with flexibility according to your financial situation. If you find yourself overwhelmed by tax obligations, the CT DRS CT-W4 plays a vital role in ensuring you manage future deductions accurately. For more personalized guidance, consider using platforms like US Legal Forms to find the necessary resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.