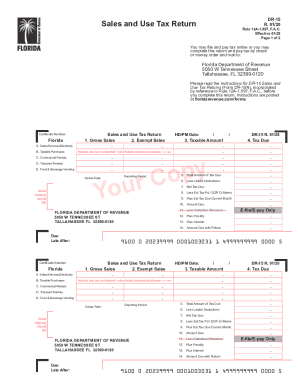

Get Fl Dor Dr-15 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR DR-15 online

How to fill out and sign FL DoR DR-15 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Experience all the benefits of submitting and finalizing legal documents online. With our service, completing the FL DoR DR-15 takes only a few moments.

We facilitate this by providing you with access to our comprehensive editor capable of altering/correcting the original content of a document, adding unique fields, and enabling e-signatures.

Submit the newly completed FL DoR DR-15 digitally as soon as you finish. Your data is highly secure, as we follow the latest security protocols. Join the many satisfied clients who are already completing legal templates from the comfort of their homes.

- Select the template you need from our assortment of legal documents.

- Hit the Get form button to access it and start editing.

- Complete all the required fields (they will be highlighted in yellow).

- The Signature Wizard will allow you to place your e-signature once you have entered the information.

- Add the date.

- Review the form thoroughly to make sure all data is filled out and no modifications are necessary.

- Click Done and save the completed document to your device.

How to alter Get FL DoR DR-15 2020: personalize forms online

Leverage the functionality of the feature-rich online editor while finalizing your Get FL DoR DR-15 2020. Utilize the array of tools to swiftly complete the blanks and supply the necessary information promptly.

Creating documentation can be time-consuming and expensive unless you possess fillable forms ready for use, allowing for electronic completion. The easiest method to handle the Get FL DoR DR-15 2020 is to utilize our expert and versatile online editing solutions. We furnish you with all the crucial tools for quick document completion and enable you to modify your templates, tailoring them to any requirements. Additionally, you can comment on the updates and leave remarks for other parties involved.

Here’s what you can accomplish with your Get FL DoR DR-15 2020 in our editor:

Utilizing the Get FL DoR DR-15 2020 in our efficient online editor is the quickest and most effective approach to managing, submitting, and sharing your documentation as per your needs from anywhere. The tool operates from the cloud, enabling access from any location on any internet-enabled device. All templates you create or prepare are securely preserved in the cloud, allowing you to access them whenever necessary and ensuring you don't misplace them. Stop squandering time on manual document completion and reduce paperwork; transition everything online with minimum effort.

- Complete the blanks using Text, Cross, Check, Initials, Date, and Sign instruments.

- Emphasize key information with a preferred color or underline them.

- Obscure private information with the Blackout tool or simply eliminate them.

- Embed images to illustrate your Get FL DoR DR-15 2020.

- Substitute the original text with the one that meets your requirements.

- Add remarks or sticky notes to communicate with others regarding the updates.

- Insert extra fillable sections and assign them to specific individuals.

- Safeguard the document with watermarks, timestamps, and bates numbers.

- Distribute the document in various manners and save it on your device or the cloud in multiple formats upon completion.

Filling out a 15 H form involves entering key information such as your name, address, and the tax period. Ensure you provide accurate details regarding your sales transactions. Utilizing resources such as the FL DoR DR-15 can guide you through the process. By carefully following these guidelines, you can avoid common mistakes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.