Loading

Get Irs 2848 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2848 online

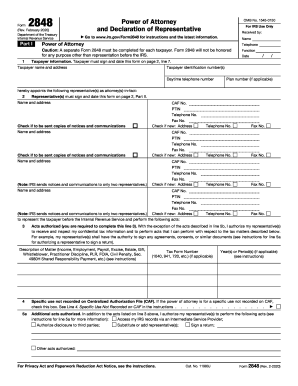

Filling out the IRS 2848 form is an important step for individuals seeking to authorize someone to represent them before the Internal Revenue Service. This guide provides clear, step-by-step instructions to help you complete the form online efficiently.

Follow the steps to complete the IRS 2848 form online.

- Click ‘Get Form’ button to obtain the IRS 2848 form and open it in your preferred online editing tool.

- Begin by entering the taxpayer's name and address in the designated section. Ensure that all details are accurate and match the information on file with the IRS.

- Enter the taxpayer identification number, which is typically the Social Security number or Employer Identification Number associated with the taxpayer.

- Fill in the taxpayer's daytime telephone number to maintain a point of contact. If applicable, include the plan number.

- Now, appoint the representative(s) by entering their names and addresses. Check the box if you want copies of notices and communications sent to them.

- Identify the acts you are authorizing your representative(s) to perform. Clearly describe the matters like income, payroll, or excise tax related to that authorization.

- Complete any additional acts authorized, such as allowing your representative to access records via an Intermediate Service Provider or add other representatives.

- If there are any specific acts your representative is not authorized to perform, list those in the designated section.

- Sign and date the form in the taxpayer signature section, ensuring all required details are provided.

- If applicable, the representative must also complete their declaration section, including their signature and date.

- Review the entire form for accuracy, save any changes, and proceed to download, print, or share the form as needed.

Complete the IRS 2848 form online today to ensure you are properly represented in your tax matters.

The primary difference between Form 2848 and Form 8821 is the authority granted. Form 2848, the IRS 2848, gives your representative the power to represent you in all tax matters, while Form 8821 allows your representative to only receive and inspect your tax information. Depending on your needs, choose the appropriate form to ensure proper representation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.