Loading

Get Irs 2159 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2159 online

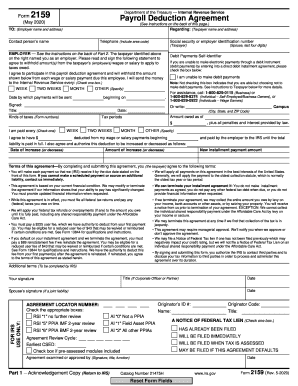

The IRS 2159, known as the Payroll Deduction Agreement, is an essential form for taxpayers seeking to set up a payroll deduction agreement with their employer to address tax liabilities. This guide provides a step-by-step approach to fill out this form online efficiently.

Follow the steps to complete the IRS 2159 online.

- Click ‘Get Form’ button to obtain the IRS 2159 form and open it in your preferred editor.

- In the section labeled 'To:', input the employer's name and address accurately to ensure proper processing.

- Under 'Regarding:', fill in the taxpayer's name and address to identify the taxpayer associated with the payment agreement.

- Provide the contact person's name and telephone number. This person will serve as the point of contact for any inquiries regarding the payroll deduction.

- Enter the social security number or employer identification number associated with the taxpayer to help the IRS identify the records accurately.

- In the section for the employer, read the agreement statement and check the frequency of payments to the IRS (e.g., weekly, bi-weekly, or monthly).

- If applicable, indicate whether the taxpayer is unable to make debit payments. If they can but choose not to, do not check this box.

- Specify the date by which payments will be sent to the IRS. This helps establish a clear understanding of payment timelines.

- Fill in the detailed information about the amount owed, including tax periods and the kinds of taxes (with corresponding form numbers). This ensures clarity in obligations.

- Review the terms of the agreement carefully. The taxpayer must understand their obligations regarding payments and potential consequences for non-compliance.

- Sign and date the form in the designated sections. If there is a spouse involved in the tax liability, their signature will also be required.

- Once completed, save the changes to the form. You may then download, print, or share the form as needed for submission.

Complete the IRS 2159 form online to establish your payroll deduction agreement today.

The best way to mail documents to the IRS is to use certified mail with a return receipt. This method gives you proof of delivery and can be particularly beneficial when submitting your IRS 2159 form. Additionally, make sure to send your documents to the correct mailing address provided by the IRS for your specific situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.