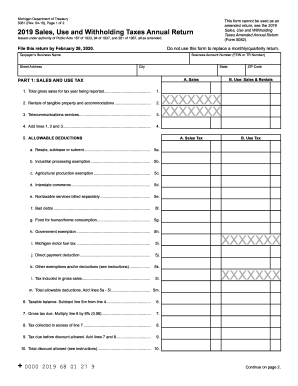

Get Mi 5081 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI 5081 online

How to fill out and sign MI 5081 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Commercial, fiscal, legal as well as other digital documents require a significant degree of safeguarding and adherence to the laws.

Our formats are revised frequently in line with the most recent revisions in law.

Our service allows you to handle the entire process of filling out legal documents online. Consequently, you save hours (if not days or weeks) and eliminate unnecessary expenses. From now on, complete MI 5081 from your residence, office, and even while traveling.

- Access the format in our comprehensive online editor by clicking on Get form.

- Complete the fields indicated in yellow.

- Press the arrow labeled Next to navigate through the fields.

- Utilize the e-signature feature to electronically sign the document.

- Include the appropriate date.

- Review the complete document to ensure you haven't overlooked any critical information.

- Click Done and download the finished format.

How to alter Get MI 5081 2019: personalize forms online

Explore an independent service to handle all your documents effortlessly. Locate, adjust, and complete your Get MI 5081 2019 in a unified interface with the assistance of intelligent tools.

The era when individuals had to print forms or even fill them out by hand has ended. Today, all it requires to obtain and finalize any form, such as Get MI 5081 2019, is to launch a single browser tab. Here, you will discover the Get MI 5081 2019 form and tailor it however you wish, from inserting text directly into the document to sketching it on a digital sticky note and affixing it to the document. Uncover tools that will make your paperwork simpler without extra effort.

Press the Get form button to prepare your Get MI 5081 2019 documentation easily and begin modifying it immediately. In the editing mode, you can smoothly populate the template with your details for submission. Just click on the field you wish to change and input the information directly. The editor's interface does not require any particular skills to navigate. Upon completing the edits, verify the accuracy of the information once more and sign the document. Click on the signature field and follow the prompts to eSign the form in moments.

Utilize Additional tools to tailor your form:

Preparing Get MI 5081 2019 documentation will never be perplexing again if you know where to find the right template and prepare it effortlessly. Do not hesitate to give it a try.

- Employ Cross, Check, or Circle tools to highlight the document's information.

- Insert text or fillable text fields with text customization tools.

- Remove, Highlight, or Blackout text sections in the document using appropriate tools.

- Add a date, initials, or even an image to the document if needed.

- Utilize the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to incorporate visual elements into your document.

Get form

Michigan sales tax increased from 4% to 6% in 2007 as part of a broader tax reform initiative. This change affected not only goods but also a range of services, prompting adjustments in sales tax collection practices. For businesses and individuals alike, staying informed about tax changes like this is critical for compliance with state tax laws, including the implications of Michigan form MI 5081.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.