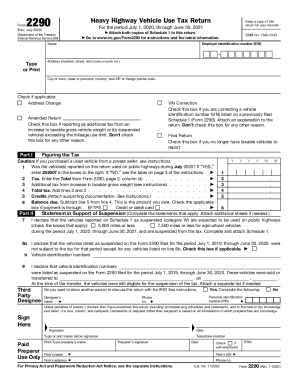

Get Irs 2290 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 2290 online

How to fill out and sign IRS 2290 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting intricate tax and legal documents has concluded. With US Legal Forms, the whole procedure of submitting official papers is stress-free. The finest editor is readily available, providing you a broad array of useful tools for completing an IRS 2290. These pointers, in conjunction with the editor, will guide you throughout the entire process.

We simplify the completion of any IRS 2290. Begin now!

- Press the orange Get Form button to begin adjusting.

- Activate the Wizard mode on the upper toolbar to receive more guidance.

- Complete every fillable section.

- Make sure the information you provide for the IRS 2290 is current and accurate.

- Add the date to the form using the Date tool.

- Choose the Sign icon and create an e-signature. You have three options: typing, drawing, or uploading one.

- Verify that every field has been accurately filled.

- Click Done in the upper right corner to export the document. There are several ways to receive the document: as an email attachment, through the mail as a hard copy, or as an instant download.

How to alter Get IRS 2290 2020: personalize forms online

Handling documents is straightforward with intelligent online tools. Eliminate paperwork with easily downloadable Get IRS 2290 2020 templates that you can adapt online and print out.

Preparing documents and paperwork must be more accessible, whether it is a routine part of one’s job or infrequent tasks. When someone needs to submit a Get IRS 2290 2020, learning rules and guides on how to complete a form correctly and what it should entail can consume a lot of time and effort. Nonetheless, if you discover the right Get IRS 2290 2020 template, filling out a document will cease to be a challenge with a smart editor available.

Explore a wider array of features you can integrate into your document workflow. No longer is there a need to print, fill out, and annotate forms by hand. With an intelligent editing platform, all necessary document processing features are always at your disposal. If you aim to enhance your workflow with Get IRS 2290 2020 forms, locate the template in the library, select it, and unearth a simpler way to complete it.

The more tools you are acquainted with, the easier it is to handle Get IRS 2290 2020. Experiment with the solution that offers everything needed to locate and modify forms in a single browser tab and forget about manual paperwork.

- If you want to insert text in any part of the form or add a text field, employ the Text and Text field tools and extend the text in the form as much as you need.

- Use the Highlight feature to emphasize the key sections of the form. If you need to obscure or eliminate some text segments, apply the Blackout or Erase tools.

- Personalize the form by including default graphical elements to it. Utilize the Circle, Check, and Cross tools to add these elements to the forms, if feasible.

- If you require extra comments, make use of the Sticky note tool and place as many notes on the forms page as necessary.

- If the form necessitates your initials or date, the editor has tools for that as well. Minimize the chance of errors by using the Initials and Date features.

- It is also feasible to incorporate custom visual elements into the form. Utilize the Arrow, Line, and Draw tools to personalize the document.

Once submitted, your IRS 2290 approval can take anywhere from a few hours to several weeks. The approval time depends on whether you filed electronically or by mail. Filing through USLegalForms often expedites this process, providing you with timely confirmations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.