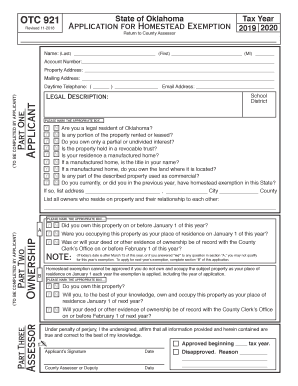

Get Ok Otc 921 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OK OTC 921 online

How to fill out and sign OK OTC 921 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing a tax document can become a significant obstacle and a considerable annoyance if adequate help is not provided.

US Legal Forms was created as an online resource for OK OTC 921 e-filing and offers various benefits for taxpayers.

Utilize US Legal Forms to ensure secure and straightforward completion of the OK OTC 921.

- Locate the template on the website within the appropriate section or through the search function.

- Press the orange button to access it and allow it to load.

- Examine the template and follow the instructions. If you have never filled out the document before, stick to the step-by-step directions.

- Focus on the highlighted fields. These are editable and require specific information to be entered. If you are uncertain about what to input, consult the instructions.

- Always sign the OK OTC 921. Use the inbuilt tool to create the electronic signature.

- Select the date field to automatically insert the current date.

- Review the document to make adjustments before submission.

- Click the Done button on the top menu once you have finished it.

- Store, download, or export the filled-out form.

How to modify Get OK OTC 921 2018: personalize forms online

Locate the appropriate Get OK OTC 921 2018 template and modify it instantly.

Streamline your documentation with an intelligent document alteration solution for online forms.

Your daily operations with documentation and forms can be more effective when you have all resources centralized. For instance, you can search for, obtain, and modify Get OK OTC 921 2018 in a single browser tab.

If you require a specific Get OK OTC 921 2018, you can readily locate it using the intelligent search feature and access it right away. There’s no need for downloads or seeking external editors to adjust it and input your information. All tools for productive work come in a unified packaged solution.

Perform additional personalized modifications with the available tools.

- This editing solution allows you to personalize, complete, and sign your Get OK OTC 921 2018 form instantly.

- Upon finding a suitable template, click on it to activate the editing mode.

- After accessing the form in the editor, you will have all necessary tools at your disposal.

- You can effortlessly fill in the specified fields and delete them if required with a straightforward yet versatile toolbar.

- Make all changes instantly, and sign the document without leaving the tab by simply clicking the signature area.

Get form

Yes, Oklahoma offers property tax exemptions specifically for seniors aged 65 and older. These exemptions can provide meaningful savings by lowering the taxable value of the property. For more detailed information on eligibility and the application process, review the resources available through OK OTC 921.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.