Get Oh Stec Co 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH STEC CO online

How to fill out and sign OH STEC CO online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax documents can present a major hurdle and significant frustration if no suitable help is offered.

US Legal Forms has been created as an online solution for OH STEC CO electronic filing and offers various benefits for taxpayers.

Click the Done button in the upper menu once you have completed it. Save, download, or export the finished form.

- Find the template on the website in the designated section or through the Search engine.

- Press the orange button to open it and wait until it is finished.

- Review the template and follow the instructions. If you have not filled out the sample before, adhere to the step-by-step directions.

- Focus on the highlighted fields. They are fillable and require specific information to be entered. If you are uncertain about what data to provide, refer to the guidelines.

- Always sign the OH STEC CO form. Utilize the integrated tool to create your electronic signature.

- Select the date field to automatically input the correct date.

- Revisit the template to review and modify it before submission.

How to Modify Get OH STEC CO 2014: Customize Forms on the Web

Completing forms is simple with intelligent online tools.

Eliminate paperwork with easily accessible Get OH STEC CO 2014 templates you can modify online and print.

Preparing paperwork and files should be more straightforward, whether it's a regular aspect of one's job or infrequent tasks. When an individual needs to submit a Get OH STEC CO 2014, researching guidelines and directions on how to accurately fill out a form and what it should comprise may consume a significant amount of time and effort. However, by locating the appropriate Get OH STEC CO 2014 template, completing a document will no longer be a struggle with an efficient editor available.

If you need to obscure or eliminate certain text portions, utilize the Blackout or Erase tools. Tailor the form by incorporating default graphic elements. Utilize the Circle, Check, and Cross tools as needed to integrate these elements into the documents.

- Explore a wider variety of features you can incorporate into your document workflow.

- There’s no need to print, fill out, and annotate forms by hand.

- With a smart editing platform, all critical document processing tools are readily accessible.

- To enhance your workflow with Get OH STEC CO 2014 forms, locate the template in the collection, click on it, and discover a more straightforward method to complete it.

- If you want to insert text in an arbitrary part of the form or add a text field, apply the Text and Text field tools to expand the text in the document as required.

- Utilize the Highlight tool to emphasize significant sections of the form.

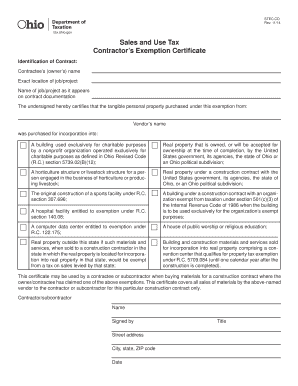

To obtain an exemption certificate in Ohio, you need to submit an application to the Ohio Department of Taxation. Ensure you include all necessary information that verifies your eligibility for tax-exempt status. The OH STEC CO site provides helpful templates and guidelines to streamline your application for an exemption certificate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.