Loading

Get Oh Sd 101 Short 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH SD 101 Short online

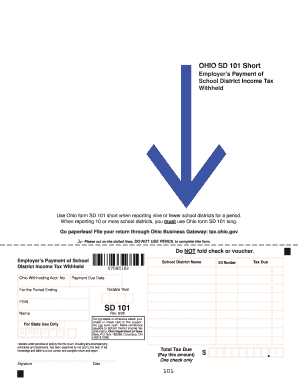

The OH SD 101 Short form is essential for employers in Ohio to report school district income tax withheld. Filling it out correctly ensures compliance with state tax regulations and helps streamline the reporting process.

Follow the steps to complete the OH SD 101 Short form online

- Press the ‘Get Form’ button to access and open the OH SD 101 Short form in your online editor.

- Fill in your Ohio withholding account number in the designated field. This number is unique to your business.

- Enter the SD number assigned to the school district for which you are reporting taxes. Ensure accuracy to avoid issues.

- Provide the name of the school district corresponding to the SD number you entered. This is crucial for proper identification.

- Indicate the total tax due in the appropriate field. Double-check your calculations to ensure they reflect the correct amount.

- Fill in the payment due date, making sure it aligns with the reporting period you are addressing.

- Specify the taxable year for which you are filing. This will typically be the current fiscal year.

- Detail the period ending date for your report by entering the correct day, month, and year.

- Input your Federal Employer Identification Number (FEIN), which is necessary for accurate tax reporting.

- Sign and date the form to certify that the information is accurate and true, understanding the penalties for false reporting.

- Finally, save your changes and choose to download, print, or share the completed form, ensuring you keep a copy for your records.

Start filling out your OH SD 101 Short form online today for a streamlined reporting experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To acquire an Ohio employer withholding account number, you need to register with the Ohio Department of Taxation. You can complete this registration online or submit a paper application. Having this account number is vital for reporting employee tax withholdings accurately. The OH SD 101 Short provides useful information to help you navigate this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.