Loading

Get Oh Rita 27 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH RITA 27 online

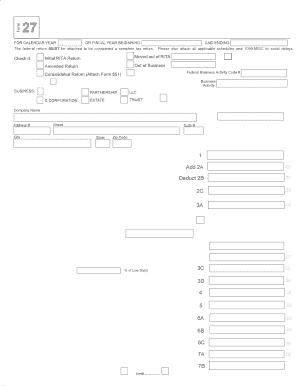

The OH RITA 27 form is essential for reporting municipal income tax. This guide provides step-by-step instructions to help users complete the form accurately and efficiently, ensuring compliance with municipal tax regulations.

Follow the steps to complete the OH RITA 27 form online.

- Press the ‘Get Form’ button to access the OH RITA 27 form. This will allow you to open the document in your online editor.

- Begin by filling in basic information in the top sections, including specifying whether this is an initial return, amended return, or if the business is out of RITA. Also indicate any special circumstances such as moving out of RITA.

- Enter your business details, including type (C corporation, partnership, LLC, etc.), Federal Identification Number, company name, address, and contact information.

- In the income section, provide income figures as reported on your federal return. Take special care to list the income per the attached federal return accurately, as these figures are crucial.

- Complete the deduction sections by detailing items not deductible from your federal return and entering the adjusted federal taxable income. You may need to refer to specific schedules for accurate reporting.

- Calculate municipal income tax due based on income calculations and any applicable credits. Ensure that the total tax distributed matches the amounts reported in previous steps.

- Review all schedules attached to the return, such as Schedule B for tax distribution within RITA municipalities and Schedule Y for apportionment, making sure all required documentation is included.

- Sign and date the form, certifying that the information provided is accurate and complete. Ensure the signature of an authorized officer or partner is included.

- Finally, save your changes. You may download, print, or share the completed form as required.

Complete your OH RITA 27 form online today to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file your OH RITA 27 taxes using Turbotax. The platform provides a user-friendly interface that guides you through the process step-by-step. By integrating RITA forms into their software, Turbotax simplifies your filing experience, ensuring you stay compliant with local tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.