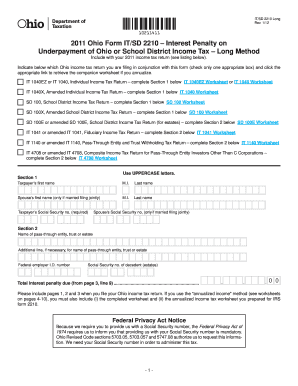

Get Oh Odt It/sd 2210 Long 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH ODT IT/SD 2210 Long online

How to fill out and sign OH ODT IT/SD 2210 Long online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own income tax returns and actually prefer to complete forms digitally.

The US Legal Forms online platform assists in streamlining the e-filing of the OH ODT IT/SD 2210 Long, making it simple and convenient. Now, it takes no longer than half an hour, and you can accomplish it from anywhere.

Ensure that you have accurately completed and submitted the OH ODT IT/SD 2210 Long on time. Review any relevant deadlines. Providing incorrect information in your tax documents may lead to hefty penalties and complications with your annual tax return. Ensure you only use verified templates from US Legal Forms!

- Access the PDF template in the editor.

- Refer to the designated fillable fields where you can insert your information.

- Select the options when you come across the checkboxes.

- Explore the Text icon and other useful features to manually modify the OH ODT IT/SD 2210 Long.

- Double-check all information before you proceed to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Certify your online document electronically and enter the date.

- Click Done to proceed.

- Download or send the document to the recipient.

How to alter Get OH ODT IT/SD 2210 Long 2011: personalize forms online

Locate the proper Get OH ODT IT/SD 2210 Long 2011 template and adjust it instantly.

Streamline your documentation with an intelligent document modification tool for online forms.

Your daily operations with documents and forms can be more productive when you have everything you need in one location. For example, you can find, acquire, and edit Get OH ODT IT/SD 2210 Long 2011 all within a single browser tab. If you require a specific Get OH ODT IT/SD 2210 Long 2011, you can swiftly locate it using the intelligent search engine and access it right away.

There is no need to download it or seek a separate editor to alter it and insert your information. All of the tools for accomplishing effective work are contained within one comprehensive solution.

After that, you can send or print your document if required.

- This editing tool allows you to change, complete, and sign your Get OH ODT IT/SD 2210 Long 2011 form immediately.

- Once you find an appropriate template, click on it to enter the editing mode.

- When you access the form in the editor, you will have all the necessary tools at your disposal.

- It is simple to fill in designated fields and remove them if needed using a straightforward yet versatile toolbar.

- Make all changes instantly, and sign the document without leaving the tab by merely clicking the signature field.

Get form

To get an Ohio tax refund check reissued, you typically need to complete a request through the Ohio Department of Taxation. You may be required to provide information about the original check, including the amount and date, along with identification. Understanding how the OH ODT IT/SD 2210 Long functions can help streamline the process. Using platforms like uslegalforms can assist in preparing the necessary documentation for your request.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.