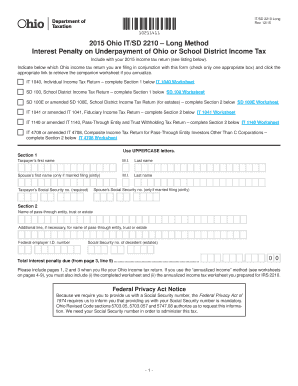

Get Oh Odt It/sd 2210 Long 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH ODT IT/SD 2210 Long online

How to fill out and sign OH ODT IT/SD 2210 Long online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans prefer to manage their own income tax preparations and, in addition, to complete forms online.

The US Legal Forms online platform facilitates the process of completing the OH ODT IT/SD 2210 Long form in an easy and convenient manner.

Make sure you have accurately filled out and submitted the OH ODT IT/SD 2210 Long on time. Consider any deadlines. Providing incorrect information in your financial declarations may lead to significant penalties and complications with your annual tax filing. Utilize only professional templates from US Legal Forms!

- Access the PDF template in the editor.

- Look at the designated fillable areas where you can enter your details.

- Select the option if you see any checkboxes.

- Navigate to the Text icon and other advanced options to customize the OH ODT IT/SD 2210 Long.

- Ensure all information is accurate before signing.

- Create your personalized eSignature using a keyboard, webcam, touchpad, mouse, or smartphone.

- Validate your web document electronically and indicate the specific date.

- Click Done to proceed.

- Download or forward the document to the intended recipient.

How to amend Get OH ODT IT/SD 2210 Long 2015: tailor forms online

Eliminate the clutter from your documentation process. Uncover the easiest method to locate, modify, and file a Get OH ODT IT/SD 2210 Long 2015.

The task of preparing Get OH ODT IT/SD 2210 Long 2015 demands precision and concentration, particularly from those who are not very acquainted with this kind of work. It is crucial to identify an appropriate template and complete it with the accurate details. With the right solution for managing paperwork, you can have all the necessary tools readily available. It is straightforward to simplify your editing tasks without acquiring new competencies. Find the right version of Get OH ODT IT/SD 2210 Long 2015 and finish it swiftly without toggling between your browser windows. Explore additional resources to customize your Get OH ODT IT/SD 2210 Long 2015 form in the edit mode.

While on the Get OH ODT IT/SD 2210 Long 2015 page, click the Get form button to commence editing it. Input your details into the form immediately, as all the key tools are right here. The template is pre-structured, so the effort required from the user is minimal. Utilize the interactive fillable fields in the editor to quickly complete your documentation. Just click on the form and enter the editor mode right away. Populate the interactive field, and your document is ready to go.

Explore more resources to modify your form:

Frequently, a minor mistake can jeopardize the entire form when it is filled out by hand. Eliminate inaccuracies in your paperwork. Discover the samples you require in no time and complete them electronically through a smart editing solution.

- Add more text surrounding the document if necessary. Utilize the Text and Text Box tools to input text within a separate box.

- Incorporate pre-designed graphic elements like Circle, Cross, and Check using the corresponding tools.

- Capture or upload images to the document when needed with the Image tool.

- If drawing is necessary in the document, use Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools for text customization within the document.

- To add comments to particular sections of the document, click the Sticky tool and position a note where desired.

Get form

The Ohio tax penalty varies based on the amount of tax due and the period of delay in payment. Generally, the penalty can be calculated based on percentage rates for both late payment and underpayment. To ensure you are accurate with your calculations, consider using the OH ODT IT/SD 2210 Long form, which outlines the specific requirements to help you manage your tax responsibilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.