Get Oh Odt It 3 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH ODT IT 3 online

How to fill out and sign OH ODT IT 3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own income taxes and, in fact, to complete forms electronically.

The US Legal Forms web service simplifies the process of e-filing the OH ODT IT 3, making it convenient and efficient.

Ensure that you have completed and submitted the OH ODT IT 3 accurately and on time. Keep in mind any relevant deadlines. Providing incorrect information in your financial documents may lead to hefty penalties and difficulties with your yearly tax return. Use only authorized templates from US Legal Forms!

- Examine the PDF form in the editor.

- Look at the highlighted fillable fields where you can input your information.

- Choose the option by selecting the checkboxes if visible.

- Utilize the Text icon and other powerful tools to manually modify the OH ODT IT 3.

- Double-check all the information before continuing to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authorize your document electronically and specify the date.

- Click on Done to proceed.

- Download or send the file to the intended recipient.

How to modify Get OH ODT IT 3 2016: personalize forms online

Utilize the appropriate document management solutions at your disposal. Implement Get OH ODT IT 3 2016 with our reliable tool that merges editing and eSignature capabilities.

If you wish to execute and validate Get OH ODT IT 3 2016 online effortlessly, then our online cloud-based solution is the ideal choice. We offer a rich template-based library of ready-for-use forms you can adjust and finalize online.

Moreover, you don't have to print the document or rely on external options to make it fillable. All necessary tools will be readily available as soon as you access the document in the editor.

Our editor simplifies the process of modifying and certifying the Get OH ODT IT 3 2016. It allows you to perform almost everything required for working with forms.

Additionally, we consistently ensure that your file editing experience is secure and adheres to primary regulatory standards. All these elements contribute to making our tool even more enjoyable.

Obtain Get OH ODT IT 3 2016, apply the necessary modifications and adjustments, and download it in your preferred file format. Give it a try today!

- Edit and comment on the template

- Utilize the left-side toolbar to rearrange the form or delete pages.

- Prepare them for distribution

- Incorporate various fillable fields, signatures, and dates for sharing.

- Implement additional features such as password protection, watermarking, and format conversion.

- Enjoy a secure and compliant experience while editing files.

Get form

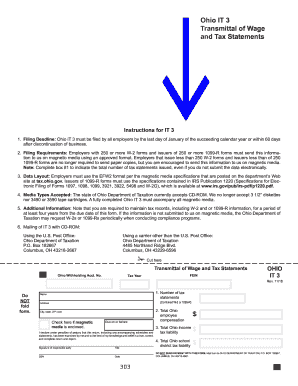

Ohio IT 3 refers to the state tax form for part-year residents and non-residents filing income taxes in Ohio. This form, also known as the OH ODT IT 3, captures essential information about your income source and helps determine your tax liability. Submitting the IT 3 allows the Ohio Department of Taxation to assess your income properly, ensuring you remain compliant with state tax laws. Use reputable services, like USLegalForms, to assist with your filing.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.