Loading

Get Oh Mvf 9 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH MVF 9 online

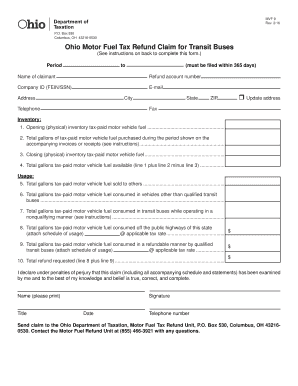

The Ohio Motor Fuel Tax Refund Claim for transit buses (OH MVF 9) is a necessary document for individuals and organizations seeking a tax refund on motor fuel. This guide provides clear, step-by-step instructions on how to complete the form online.

Follow the steps to complete the OH MVF 9 online.

- Press the 'Get Form' button to access the online version of the OH MVF 9 and open it for editing.

- Enter the period for which you are filing your refund claim at the top of the form. Ensure that the dates are within 365 days of the fuel purchase.

- Provide your name as the claimant, and include your refund account number as well as your company ID (FEIN or SSN).

- Fill out the fields for your email address, physical address, city, state, ZIP code, and telephone number.

- If your address has changed, check the 'Update address' box.

- In the inventory section, input the opening inventory of tax-paid motor vehicle fuel, total gallons purchased, and closing inventory, following the instructions for accuracy.

- Calculate the total gallons of tax-paid motor vehicle fuel available for use by adding line 1 and line 2, then subtracting line 3.

- Complete the usage section by entering the total gallons sold to others, consumed in vehicles other than qualified transit buses, and used in a non-qualifying manner when applicable.

- Document the gallons consumed off public highways as well as those used by qualified transit buses, ensuring all entries reflect accurate records.

- Calculate the total refund requested by adding the amounts from lines 8 and 9.

- Affix your printed name, title, signature, and date at the bottom of the form, along with your telephone number.

- Save your changes, and download or print your completed form for submission.

Complete and submit your OH MVF 9 online today to claim your motor fuel tax refund.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligibility for the fuel tax credit in Ohio typically includes businesses that use fuel for non-highway purposes. This can apply to agriculture, commercial transportation, and certain government operations. To navigate the eligibility requirements, consider resources like uslegalforms, which can streamline the application process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.