Loading

Get Oh It Re 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH IT RE online

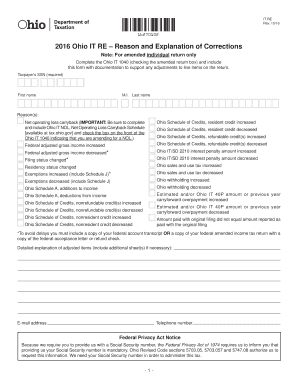

The OH IT RE form is essential for individuals submitting an amended tax return in Ohio. This guide will walk you through each section of the form, ensuring you understand how to complete it accurately and efficiently.

Follow the steps to fill out the OH IT RE form online.

- Press the ‘Get Form’ button to access the OH IT RE form and open it in your document management system.

- Enter your Social Security number (required). This is a mandatory field necessary for processing your amended return.

- Fill in your first name, middle initial, and last name as they appear on your original return.

- Select the reason or reasons for your amendments by checking the appropriate boxes. Ensure to provide any additional necessary documentation that supports these adjustments, such as schedules or transcripts.

- In the 'Detailed explanation of adjusted items' section, provide a thorough explanation for the changes made. If more space is needed, attach additional sheets detailing your reasons.

- Enter your email address and telephone number to ensure the tax authority can reach you if necessary.

- Review all the information you have provided to ensure accuracy. Double-check your Social Security number, names, and reasons for amendments.

- Once you have completed all sections and verified the information, you can save your changes, download the completed form, print it, or share it as required.

Complete your OH IT RE form online today to ensure timely processing of your amended return.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For tax withholding in Ohio, deciding between 0 or 1 depends on your current tax situation. Claiming 0 results in higher withholding, potentially leading to a tax refund. Claiming 1 might be suitable if you're single and not supporting any dependents. Analyzing your income and deductions can help you make the right choice.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.