Get Ca Ftb 540a 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540A online

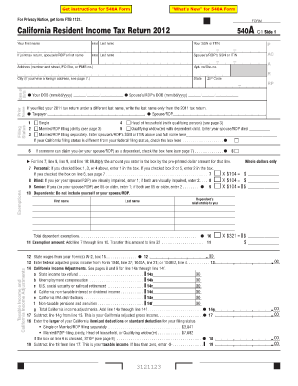

The CA FTB 540A is the California Resident Income Tax Return form for the 2012 tax year. This guide provides comprehensive instructions on how to complete the form online, ensuring that you submit an accurate and complete return.

Follow the steps to successfully complete the CA FTB 540A online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your personal information in the designated fields, including your first name, initial, last name, and social security number (SSN) or individual taxpayer identification number (ITIN). If filing jointly, ensure to include your spouse’s or registered domestic partner’s details as well.

- Provide your current address, including the city, state, and ZIP code. If you have a foreign address, refer to the provided guidance.

- Indicate your date of birth and, if applicable, the prior name you used for your 2011 tax return.

- Select your filing status from the options provided: head of household, single, married/RDP filing jointly, married/RDP filing separately, or qualifying widow(er). Make sure to check the box if someone can claim you or your spouse/RDP as a dependent.

- Complete the exemptions section. Enter the appropriate values for personal exemptions, senior exemptions, blind exemptions, and dependent exemptions. Sum these figures and transfer the total to the designated line.

- Continue to the income section by entering state wages from your W-2 forms and your federal adjusted gross income (AGI).

- Include any California income adjustments as outlined in the form, summing these adjustments and placing the total in the appropriate box.

- Calculate your taxable income by subtracting your deductions from your California AGI. Be mindful to enter zero if the result is negative.

- Determine your tax using the appropriate tax table, and enter this amount in the tax section of the form.

- List any available credits and calculate your total tax liability by subtracting credits from the total tax.

- In the payments section, detail any California income tax withheld, estimated tax payments, and other credits. Compute your total payments.

- Finally, review your calculations to determine if you owe tax or if you are entitled to a refund. If applicable, fill out the direct deposit section for your refund.

- Complete the declaration section by signing the form. If filing jointly, both you and your spouse/RDP must sign. Include contact information if desired.

- Once all sections are complete, save changes, and choose the option to download, print, or share the form as needed.

Start filling out your CA FTB 540A online today to ensure timely and accurate submission of your tax return.

Related links form

To properly fill out the employee’s withholding allowance certificate in California, start by entering the employee's personal information, like their name and Social Security number. Next, choose the correct filing status and number of allowances, then ensure the employee signs the form. Completing this accurately is vital for precise withholding and will streamline the process when preparing to file the CA FTB 540A.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.