Get Nyc Dof Att-s-corp 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

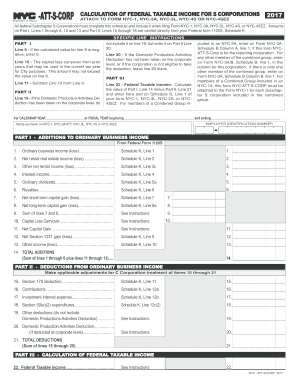

This guide provides essential instructions for users on how to efficiently complete the NYC Department of Finance ATT-S-CORP form online. Following these detailed steps will help ensure that users accurately report their federal taxable income as required for S corporations.

Follow the steps to complete the NYC DoF ATT-S-CORP form online.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by entering your calendar or fiscal year dates in the designated fields to specify the period for which you are reporting.

- Provide the name of the corporation exactly as it appears on NYC-1, NYC-3A/ATT, NYC-3L, NYC-4S, or NYC-4SEZ.

- Enter the Employer Identification Number (EIN) of the corporation in the space provided.

- In Part I, start filling out the various types of income under the 'Additions to ordinary business income' section by entering the required amounts for lines 1 through 9.

- If applicable, outline the capital loss carryover in line 10 and proceed to calculate the net capital gain in line 11.

- After completing Part I, calculate and enter values in Part II, focusing on the deductions for lines 15 through 21, adjusting for any C Corporation treatment.

- Complete Part III by calculating the federal taxable income on line 22, ensuring it reflects the total revenues and deductions accurately.

- Review all entries for accuracy and completeness before finalizing the form.

- Once all information is correctly filled, you can save your changes, download a copy of the form, print it, or share it as needed.

Submit your completed NYC DoF ATT-S-CORP form online to ensure compliance with federal tax regulations.

Get form

Choosing between an S Corp and an LLC in NYC depends on your specific business needs and circumstances. Generally, S Corps may have lower overall tax liabilities due to pass-through taxation. However, the initial setup and ongoing compliance costs can vary significantly. It's important to compare these factors thoughtfully, considering the NYC DoF ATT-S-CORP guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.