Loading

Get Ny Substitute Form W-9 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Substitute Form W-9 online

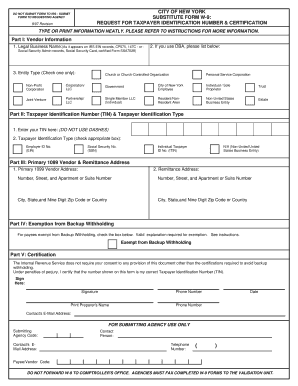

Completing the NY Substitute Form W-9 is essential for vendors and businesses to provide their taxpayer identification information. This guide will offer clear and structured steps to assist you in filling out the form online accurately and efficiently.

Follow the steps to fill out the NY Substitute Form W-9

- Press the ‘Get Form’ button to acquire the form and display it in your preferred editing environment.

- In Part I, enter your legal business name as it appears on IRS records. If you operate under a different DBA, provide that name in the designated space.

- Select your entity type by checking the appropriate box, ensuring you choose only one option from the list provided.

- Move to Part II and input your taxpayer identification number. Do not include any dashes. Then, mark the type of identification you are providing—either EIN, SSN, ITIN, or indicate if you are a non-United States business entity.

- In Part III, provide your primary 1099 vendor address followed by the remittance address, ensuring to fill out the street address, city, state, and zip code accurately.

- For Part IV, if you are exempt from backup withholding, check the corresponding box and provide any necessary explanations as outlined in the instructions.

- Finally, in Part V, certify that the information provided is correct by signing where indicated, typing your name, and recording the date. Include your phone number and email address for contact purposes.

- After ensuring all fields are completed accurately, save your changes. You can then download, print, or share the completed form as needed.

Complete your documents online to streamline your submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To properly fill out the NY Substitute Form W-9, start by entering your name and taxpayer ID accurately. Follow this by providing your business information if applicable and ensuring you check the right boxes indicating your tax classification. Lastly, review the form for any errors before submitting it. If you need assistance, platforms like uslegalforms provide helpful resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.