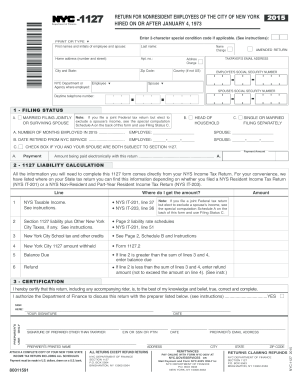

Get Ny Nyc-1127 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY NYC-1127 online

How to fill out and sign NY NYC-1127 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Today, the majority of Americans usually favor handling their own tax returns and, in addition, filling out forms digitally.

The US Legal Forms online platform simplifies the task of preparing the NY NYC-1127, making it quick and convenient.

Ensure you have properly filled out and submitted the NY NYC-1127 on time. Consider any relevant deadlines. Providing inaccurate information in your tax documents may result in heavy penalties and complications with your annual tax return. Utilize only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Refer to the highlighted fillable fields to enter your information.

- Select the option when you view the checkboxes.

- Use the Text tool and other advanced features to manually edit the NY NYC-1127.

- Double-check all the information before signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your template online and indicate the specific date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to modify Get NY NYC-1127 2015: personalize forms online

Bid farewell to an outdated paper-centric method of filling out Get NY NYC-1127 2015. Get the document completed and validated swiftly with our expert online editor.

Are you struggling to alter and fulfill Get NY NYC-1127 2015? With a powerful editor like ours, you can accomplish this task in just minutes without the hassle of printing and scanning paperwork repeatedly. We offer entirely adaptable and user-friendly form templates that will serve as a foundation and assist you in finishing the required form online.

All forms, by default, consist of fillable fields you can complete when you access the form. However, if you wish to enhance the current content of the document or add new elements, you can choose from a variety of editing and annotation tools. Emphasize, conceal, and comment on the text; add checkmarks, lines, text boxes, images, notes, and annotations. Furthermore, you can effortlessly certify the document with a legally-recognized signature. The finalized document can be shared with others, stored, imported into external applications, or converted into any widely-used format.

You’ll never regret choosing our web-based tool to fill out Get NY NYC-1127 2015 because it's:

Don't squander time completing your Get NY NYC-1127 2015 the outdated way - with pen and paper. Utilize our comprehensive solution instead. It provides you with a flexible array of editing options, integrated eSignature functions, and convenience. What makes it exceptional is the team collaboration capabilities - you can collaborate on forms with anyone, establish a well-organized document approval process from start to finish, and much more. Explore our online solution and get great value for your investment!

- Simple to set up and navigate, even for individuals who haven’t filled out paperwork electronically before.

- Strong enough to accommodate various modification needs and form types.

- Safe and secure, ensuring your editing experience is protected each time.

- Accessible across multiple operating systems, making it easy to complete the form from anywhere.

- Able to generate forms based on pre-designed templates.

- Compatible with various file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Residents of New York City who earn income, either through employment or self-employment, must file a New York City tax return. This requirement also extends to non-residents who earn income from NYC sources. Using the proper forms, including NY NYC-1127 if claiming the school tax credit, is fundamental for compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.